BREAKING PROPERTY NEWS – 28/03/2022

Daily bite-sized proptech and property news in partnership with Proptech-X.

The Blockbuster to Netflix Evolution: Is the estate agency sector finally having its moment with new Foxtons approach?

Since 2017, like a prophet in the wilderness I have been proclaiming that estate agents with tech are losing market share to other agents who do not use it. Property technology when utilised correctly automates processes, but more importantly with data science and machine learning, big data becomes liquid gold. With it, the C-suite can quite literally predict the future by tapping into what is happening right now.

Foxtons has just announced that it has been utilising the services of DataRobot, an American VC-backed data analytics and modelling outfit that creates bespoke machine learning models for its clients. Its tech scours millions of data points to find the hidden patterns of consumer behaviour, giving the agency insight into who is the best type of customer and what they are going to do next.

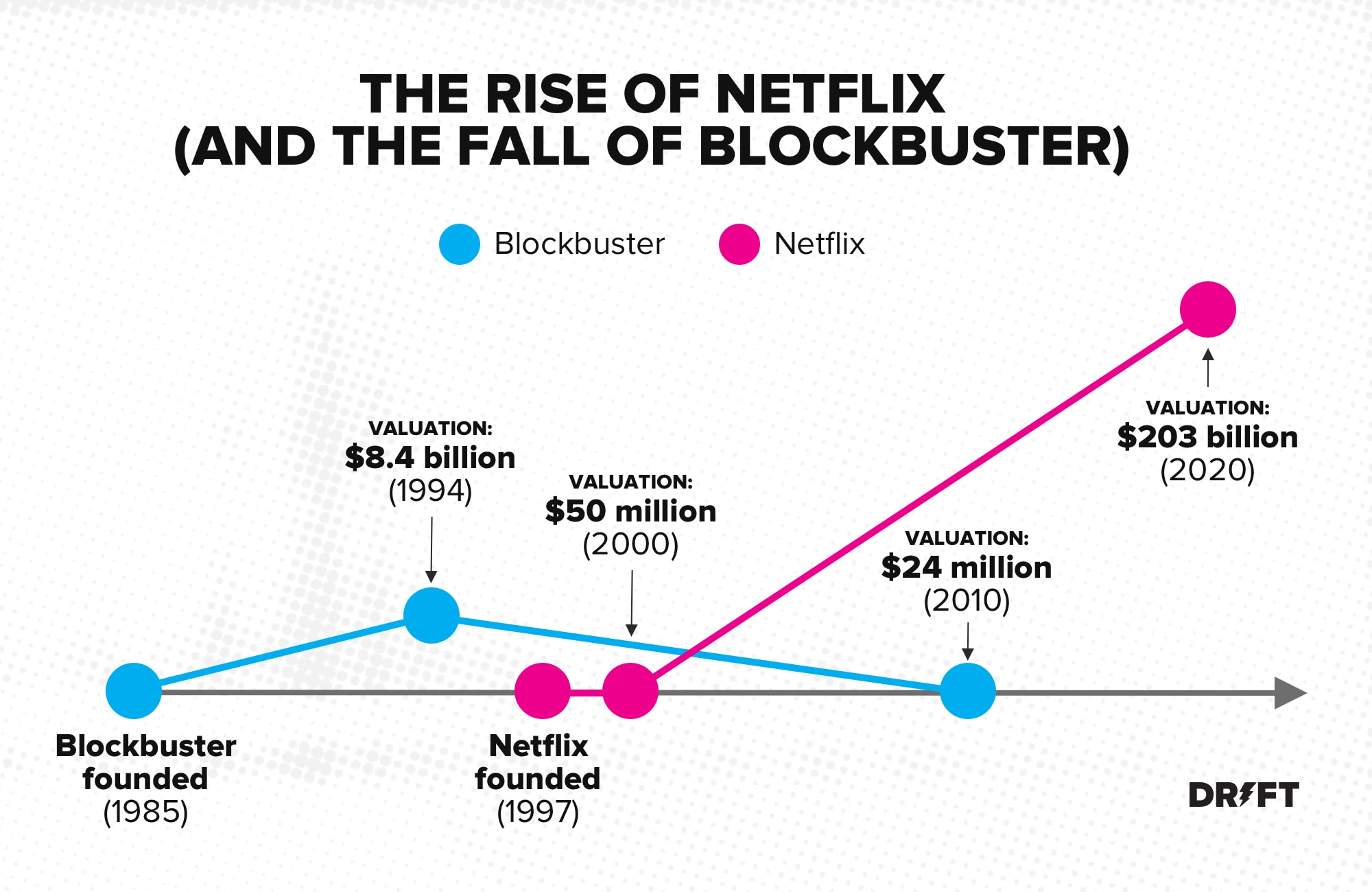

Remember Blockbuster, a huge American video rental company? It grew to over 9,000 branches all across the world, with the majority in America. It was the undisputed king, then in 2000 its revenue started to go backwards, and by 2010 it ran out of money. Finally, in 2011, its last remaining branches were sold off.

Netflix, which itself had started as a video rental business and was at one point poised to take over the video rental chain, did something very different. Instead of thinking it was in the video leasing and video gaming business, it realised it was in the servicing people business, the user experience business.

It spent a large amount of cash and put data intelligence behind its operation, analysing the data to see what its customers were doing and were likely to do. Whilst Blockbuster was pouring cash into advertising and carrying on as before, the agile Netflix began to see patterns of behaviour. For example, they could see who rented what and could target two different clients in the same household by marketing to them in two different ways.

They could do all of this as they drilled down into what the client wanted and when, then they used that intel to be ahead of the game, focusing on the high growth, high-value strategies. Whilst Blockbuster ploughed on, failing to see that technology could have been its saviour. Netflix became the victor and Blockbuster went the way of the dinosaurs, consigned to history.

Now, it is understood that Foxtons has been looking at the propensity of which potential vendors might be looking to list with a similar strategy, a key route to unlocking revenue. Machine learning can unlock all the mysteries of the real estate marketplace.

That is where the now-defunct Countrywide PLC, the assets of which are inside Countrywide Ltd owned by the Connells group, went wrong.

Instead of signing marquee hires like Alison Platt, who drove the company into the ground, they should have spent those eyewatering salaries on new tech. With the vast amount of transactions taking place in that company, the ability to monetise great data insights would have been unstoppable.

For any agency that needs a clear strategy to de-risk themselves from their analogue based DNA, I am more than happy in my day job as CEO of PROPTECH-PR to give advice on what you should be doing on a consultancy basis.

I will not sell you shiny new software solutions as I am not in sales, but I will show you what the future is and how to best prepare to make a lot of profit from it. Having met over 500 property technology and fintech founders I have a pretty shrewd handle on what real estate in the 2030s will look like.

Using technology is not easy, cheap or quick, but the alternative is to often wake up one morning and realise that your local competition has eaten your digital shorts, and their software is producing predictable profit day after day after day. And you are just doing your analogue groundhog day, because it is what you do.

Amazon is a $1.7 trillion valued company, its profits rising by 40% during the pandemic. Why? Because we were locked down? Partially, but the other part is they understand user experience, they read our minds digitally and provide a smiling cardboard box the next day.

Real estate can be like this too if companies use tech to get smart. These kinds of companies retain clients.

Credit for the news piece: Foxtons

Who is to blame for gazumping?

The shortage of property is causing hotspots and rampant gazumping which, for those who are unaware, is when a sale is agreed a new buyer comes in to offer a higher figure.

In a recent survey, HBB solutions stated that 10% of buyers were presently being gazumped and that the sentiment was that gazumping should banned. Chris Hodgkinson, MD, stated that “gazumping still occurs in this day and age and, in fact, it’s probably fair to say it’s rife in current market conditions. Unfortunately, it’s a by-product of a market where demand is incredibly high and stock levels remain insufficient for such a prolonged period of time.”

Apparently, the HBB survey – which was only 1,000 buyers out of 1.34 million completed sales last year – found that 85% of the respondents wanted gazumping to be cut out. I, however, am not so sure.

First, the only people who allow it to happen are vendors. All other stakeholders in the process are passengers, it is the vendor alone who allows a sale at a higher level if they so wish. The agent often gets a bad reputation as the original buyer loses the property they wanted to buy, but they are just following the vendor’s instructions. Agents are legally bound to forward all offers on a property at all stages up to an exchange of contracts.

Second, a high number of buyers are also vendors. Yes, there are first time buyers in the mix, but an awful lot of buyers are themselves selling to a buyer. If they adopted a strict code of not allowing gazumping that would certainly minimise the problem.

The third problem is that property prices are racing upwards and property is scarce, which means that a buyer at the top of a chain may take weeks or months to find. The danger then is that all property in that chain is undervalued, as in 10-weeks a three-bedroom semi-detached that sold for £375,000 might now sell in a day for £395,000.

So if a second-string buyer comes forward and offers on one of the properties in that chain, who is to say who is in the right or the wrong is it not just market dynamics?

If you have a view – please let us all know by emailing me at editor@stagingsite.estateagentnetworking.co.uk – Andrew Stanton Executive Editor – moving property and proptech forward.