Busy start to 2018 with increased home-hunter activity

- Early traffic data indicates a busy start to 2018, with Rightmove visits up by an average of over 9% so far in January compared to same period last year1, averaging over 4 million visits per day

- Average price of property coming to market is up 0.7% (+£2,067) this month on Rightmove, tracking over 90% of the UK property market, similar to the 0.6% rise at this time a year ago with virtually identical number of properties coming to market

- To have the best chance of a successful sale this year, sellers should note:

- Buyers are still price-sensitive with sales agreed numbers in the last quarter of 2017 down 5.5% on the same period a year ago

- Sellers of properties suitable for first-time buyers set to have greatest chance of sales success following last Autumn’s stamp duty saving boost

Early indicators of activity in this year’s housing market show that demand remains robust, and most of the key metrics are broadly consistent with the same period last year. Demand as evidenced by visits to Rightmove shows the average so far in January is currently running over 9% higher than the same period a year ago, with an average of over 4 million visits each day. The rate of increase in the price of property coming to market is consistent with last year, up by 0.7% (+£2,067) this month versus +0.6% in the same period 12 months ago. In spite of the high level of home-hunter visits as we start 2018, sellers should note that buyers are still being very choosy, as shown by the number of sales agreed in the last quarter of 2017 being lower than a year ago in all regions.

Miles Shipside, Rightmove director and housing market analyst comments: “Considering some of the gales that buffeted the market in the latter part of 2017, these early readings for 2018 show that there is currently a good following wind of search activity. To keep this year’s initial buyer momentum with you rather than against, serious sellers should note that all regions are currently selling at a slower rate than a year ago, indicating choosier buyers. The total number of sales agreed was 5.5% down in the last quarter of 2017 compared with the same period in 2016. Setting tempting asking prices and then quickly reducing them if there is little initial interest will be key to turning this promising level of buyer activity into actual sales, especially in the less active sectors and locations of the UK.”

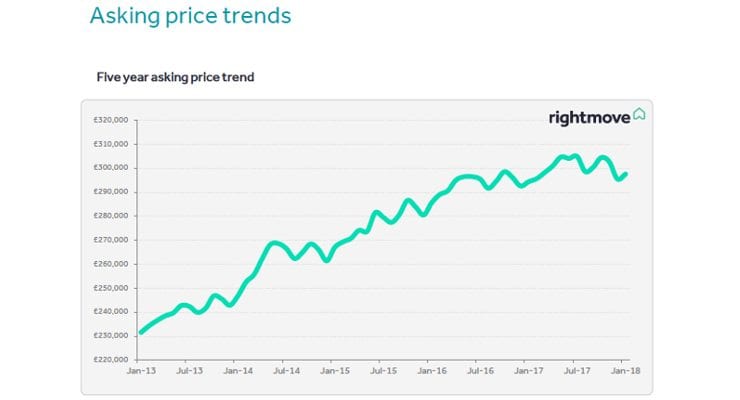

The annual rate of price increase in newly-marketed property is 1.1%, although at a more local level prices are running 4-6% up in some regions, with only London (-3.5%) recording a year-on-year fall. While the 0.7% increase in asking prices of property coming to market this month is very similar to the 0.6% of the same period a year ago, both years are well behind the average monthly rise of 1.9% seen at this time of year in the faster-rising markets from 2013 to 2016. However, the current market’s negative price factors of stretched buyer affordability and uncertain political outlook are counter-balanced to a degree by tight supply of suitable properties for sale and the recent near-abolition of stamp duty for first-time buyers. There is no increase in choice for buyers, with average overall stock per estate agency branch holding steady at 42 properties, the same as a year ago.

Shipside adds: “There is no sign so far of any rush to come to market and try to sell, with the number of new-to-the-market properties holding steady against the same period a year ago at around 63,000. With no increase in fresh supply, and an overall average of 40% of properties on agents’ books already sold subject to contract, would-be buyers in some sectors and locations of the UK are seeing less choice to tempt them, fuelling some localised price rises. While potential buyers are still busy looking, they are looking for good value and the right property . Price rises have had a good run and the return of the days of optimistic pricing is consequently some years away and contingent upon earnings increasing and interest rates remaining low. Sellers should get good local advice to ensure that their property price and presentation are suitable for their local market conditions.”

The boost given to first-time buyers by the abolition of stamp duty for most of their purchases means that properties in that sector are facing higher demand and consequently more upwards price pressure, especially if supply is limited. Indeed their typical target sector of two bedrooms and fewer has seen the biggest rise of 1.1% in the last month, ahead of second-stepper properties at 0.4% and top of the ladder at 0.8%.

Shipside predicts: “Those selling to ‘quick-off-the-block stamp-duty-saving first-time buyers’ are set to have a busier first quarter than those trying to sell in other sectors. We expect that many first-time buyers will act fast to satisfy their appetite to get onto the housing ladder and secure their property at today’s prices, before any stamp duty savings are eaten up by rising property prices.”