Estate Agent lists Haunted Property which have heavy discounts:

The beauty of searching through social media and Google’s latest news results is that you come past all kinds of interesting facts and news stories. As we try our best here on Estate Agent Networking to bring you educational and entertaining posts over content which simply you are not interested in, sometimes something jumps out at you that I think others in the industry will enjoy reading…

If I said ‘Who you gonna call… ?’ then I am sure many of you, in your mind or you actually said it under your breath, will think of GhostBusters (yes, Ghostbusters does have a Twitter account bytheway) – Sometimes even us in Estate Agency thinks of ghosts and even more scary and creepy facts in order to attract viewers to listings.

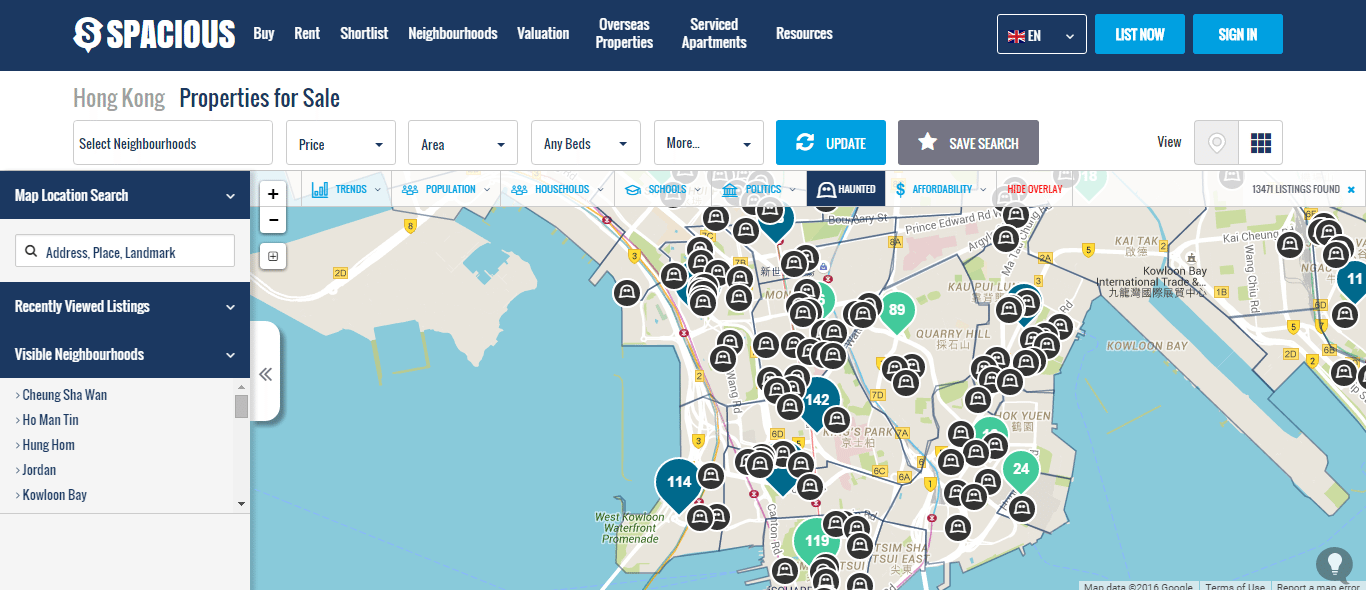

Spacious.hk is a website for property in and around Hong Kong which will appear very normal on our first glance, but when you start searching for property is when you are presented with the option to search for haunted listings with the reason being that you can potentially find a bargain.

With Hong Kong being now the world’s fourth most densely populated city and having 7 million in population, property is in high demand with average rental/mortgage bills of £3,800 for a three-bedroom apartment. People will always be searching for under value / discounted property and by having the option to search through haunted there are many property that come with a dark past history which reduces their value.

When Haunted is clicked the map will present ghost icons where if you hover over each one it highlights the tragic story that listing holds, ie ‘Business man jumped off building due to relationship problems‘, ‘Old man was burnt to death in bed whilst smoking‘ & ‘Female hanged herself’… Many listings state jumping off buildings and there are quite a few live listings to investigate – Ideal if you are looking for a bargain in Hong Kong.