French mortgages: buying property across the Channel

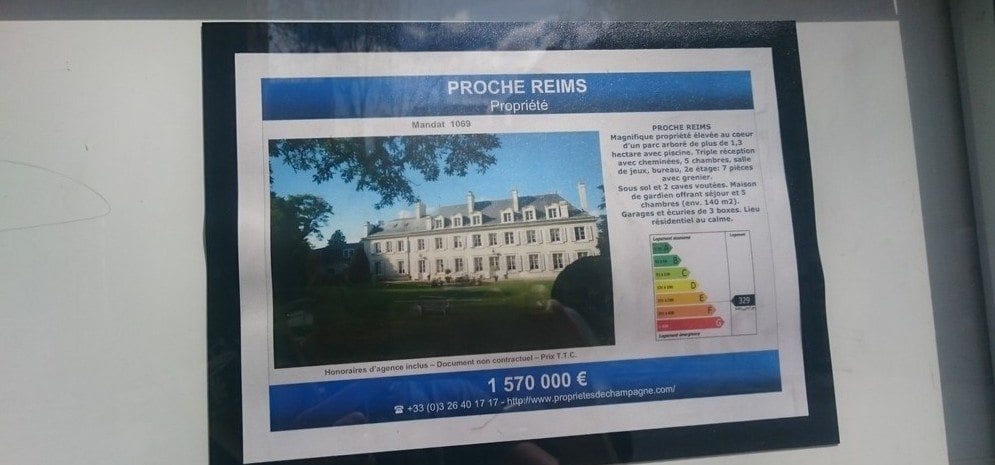

Despite competition from emerging European property markets, France remains one of the most popular second home destinations for UK buyers. It is not hard to see why it retains its appeal; whether you’re after a luxurious villa on the Riviera, a rustic farmhouse nestled in the vineyards of Provence or an elegant Parisian penthouse, French property is hard to beat. Popular areas include the sunny south and snowy east – Aquitaine and the Alps – as well as the perennially in-demand capital.

Just like pretty much anything worthwhile, French mortgages aren’t straightforward. The process is famously exhaustive, and borrowers must satisfy a range of requirements. It is vital to engage an expert broker – not only to explain your options to you and help prepare your application, but to work with the French authorities on your behalf. We are therefore delighted to announce Enness is launching a specialist French mortgages division. Our advisers are fluent in French and have years of experience in the sector, and could make that dream of a chateau in the Loire come true.

How do French mortgages differ from UK mortgages?

Anyone wishing to purchase a property France will need to register their mortgage with a French lawyer called a notary, or ‘notaire’. For many, the language barrier will be felt keenly at this stage; nor can you rely on estate agents – particularly in the rural south – being able to speak English. This is one of the many reasons why an intermediary is key. Our French mortgage specialists can liaise with your notary, estate agent and any other French-speaking party involved during the purchase process to ensure that completion is achieved as quickly and smoothly as possible.

It is fair to say French lenders leave no stone unturned when assessing the finances of prospective borrowers. A small mountain of paperwork, from passport photos and pension statements to P45s, is required, meaning the preparation stage is more time consuming than for a UK mortgage application. Once you are in a position to submit, there are two key requirements you must satisfy. The first is a sufficiently low ‘debt-to-income’ ratio; underwriters will divide your outgoings by your total monthly income to determine your ratio. The second is the ability to demonstrate a sufficient level of savings to afford the purchase. Being able to demonstrate a strong capacity to save is key to the success of your application. Here at Enness, we will make sure that your file is presented to the lender in the best light possible.

Although it may seem complicated, there are a couple of very appealing aspects of French mortgages. Firstly, you can ‘fix’ for the entire term of the mortgage as opposed to the two or five year fixed rates common in the UK. With rates currently at an all-time low, this is a huge perk for buyers. Secondly, Early Repayment Charges (ERCs) can be eye-watering in the UK. In France, they are minimal; if you want to repay your mortgage ahead of schedule, you can expect to be charged as standard just 6 months’ interest on the amount redeemed.

“The ability to lock into an interest rate for up to 25 years, combined with French mortgage rates standing at historically low levels, means there has never been a better time to buy in France,” says Hugh Wade-Jones, Managing Director at Enness Private Clients. “At Enness we have access to a plethora of options – one of the best at the moment is a 2.45% 20-year fixed term. The current market is awash with these amazing deals.”

Just like in the UK, there are capital repayment and interest only options available, although for the latter you will need to demonstrate a high level of savings. In terms of timeframe, 2-3 months from application to completion is standard, although our advisers have managed to squeeze it down to 1 month in the past.

Non-purchase mortgages are also available in France, albeit trickier to secure than in the UK. French lenders do not tend to have as large an appetite for construction, renovation or remortgage projects as they do for straight purchases. Do not hesitate to contact Enness if you are looking to finance such a project, however – our brokers will do their best to find a solution for you.

Once you’ve been approved for a mortgage with one of the French lenders, don’t be fooled into thinking the process is over and the funds are yours. Since the loan must be repaid in euros from an account in France, you will need to open a French bank account. Additionally, in the vast majority of cases the lender will insisted you take out a life insurance policy covering the mortgage, regardless of whether you have pre-existing cover or not. As part of the French mortgage service at Enness, these provisions (along with all other ancillary requirements) can be arranged on your behalf, lifting the burden from your shoulders.

At Enness we know the process inside out; we will guide you through it step-by-step, work with the French authorities on your behalf and make your mortgage as hassle-free as possible. If you would like to find out more, please do get in touch.

For more information about Mortgages in France contact Enness Private.