French Property for Sale Marketing and PR

Facebook’s ‘French Property for Sale‘ Group where anyone and everyone that is involved in or loves French Property can join. If you are a private seller or estate agent/immobilier then do feel free to advertise individual listings for sale/rent. If you are searching for a property in France then do feel free to let the group know your requirements.

Love of French property remains strong and especially for the Brits with over 150,000 British expats living in France, making it the second most popular European country for British nationals. French property prices remain still relatively cheap compared to average prices in the UK with a majority of British buyers looking to purchaser cheaper property usually rural located and needed renovation works.

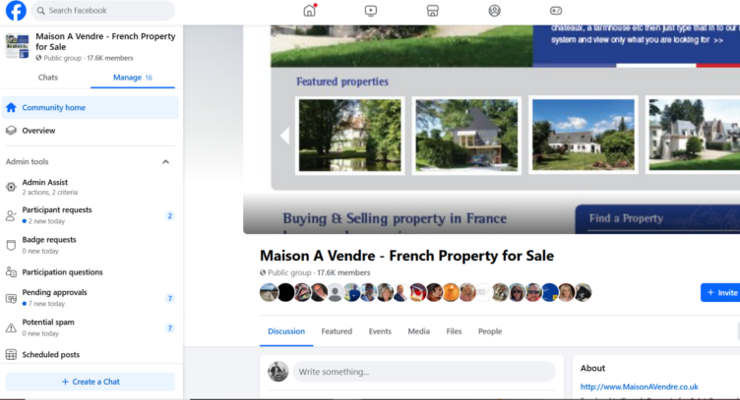

With over 17,500 members and 100 of French Property listings added monthly, the French Property for Sale Group on Facebook is an ideal place to sell and buy property and for service providers to reach an active target audience – This group is currently for sale so please contact Christopher via propertywine@gmail.com

Top reasons why British love French Property:

- Cheaper prices

- Ideal location for second homes

- Quieter lifestyle

- Cheaper living

- Healthier lifestyle

- Warmer weather

- Love of food and wine

- Leisure activities to include sports

- Unhappy with current affairs of Britain to include Brexit

Maison A Vendre / French Property for Sale Facebook Group:

Feel free to discuss anything to do with French Property such as mortgages, businesses for sale, holiday rentals, property prices etc.

If you offer a service that helps French Property, such as removal firms, satellite installations, currency transferring, health care, cheap telephone calls and similar then find out more about working with us by emailing propertywine@gmail.com