Half the property I have viewed have now had Price Reductions!

House prices: Is it time to sit still and wait, will the time of gazundering be upon us soon, is Brexit only just taking effect on the property market or maybe it is all just a minor storm in a teacup?

For those readers looking to purchase at present and that will involve some selling and buying at the same time and also those in a great position of nothing to sell, just how are you seeing the current market trend for your area? Some parts of the UK are reporting that prices are holding up whereas others that prices are falling and this being mostly highlighted in London.

Have we had just too many good years of prices rising on no foundations, maybe a trend with no motive or reason or will Brexit, if and when and how it happens, take a big effect in that housing shortage figures will decrease as immigration figures fall? A tougher money making system in place now for landlords means that stocks are being dumped by many (trust me I can see them flooding on to the market where I search for property and I have viewed a few which are usually the cheaper and less appealing examples, ie corner plots or those on ugly main roads), today it is widely spoken about that money is better invested outside of property in the UK.

So, as I like to say, Brexit is currently ‘yes, no or maybe so’ in the hands of the Prime Minister so a negative and frustrated vibe is pushing out across the UK as much as the increasing divide between those pro remain and those pro leaving. Is now the right time to buy just before what we know will be happening, or should we stick to buying after (if in-deed an after is in view yet or ever to happen)? Maybe an offer on a property at this moment and then an even more negative decline in the economy & house prices in-between completion of the sale and key exchange may see you re-adjusting that initial agreed price lower? Maybe you are seeing property thereafter coming on to the market at more attractive prices at several %’s below than price you are about to pay?

Of course, if you are buying and selling at the same time then the hit is less on you, if you are pulled down on the price you are selling then you accommodate that on the price you are paying – If you are just buying then you have the royal flush in your hands and you don’t even need to be playing with poker eyes, you dictate what you want to pay on the current market conditions and if it continues in the way in has been then that can only mean you get batter value for your money.

Half the property I have viewed have now had Price Reductions:

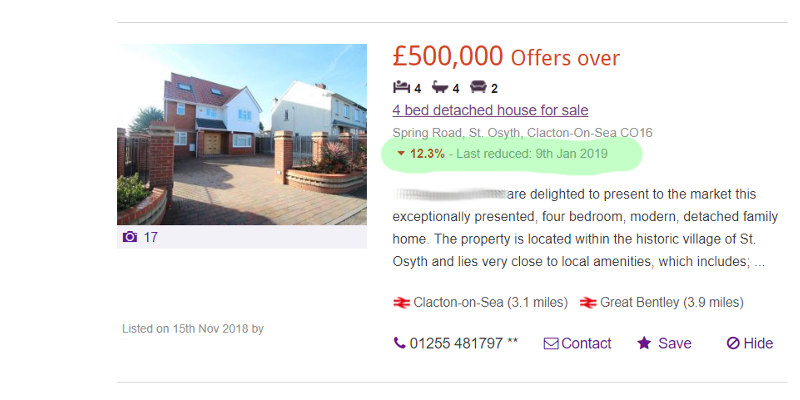

I have viewed ten property now from those which are of interest and to also gather ideas on options of what our money can achieve. Out of the ten property we have viewed only one has currently a sold sign up where as the rest are still for sale and 5 of the property have since had reduced prices added (this is within a 5 month period). It is amazing that we saw the five property at one price and now they have fallen, though to be honest only one of the price reductions increased our interest in the said property – Price reductions have ranged from £25,000 to just £5,500.

Out of the ten property we have viewed two have had similar property in the same road / immediate area that have come on to the market since at either similar or a touch below – Never each time to really attract us away whereas say a 10% price difference of course would.

From our point view it is worthwhile waiting as stock seems to be increasing and nothing in the foreseeable future would say we will see an immediate spike in property prices. The way we buy property in the UK does mean that the time it takes from offer to key exchange leaves things very open and in today’s market this mean the seller will be more anxious over the buyer in most occasions so even if an offer is placed and accepted, we can have just reason to withdraw an offer as for sure temptation elsewhere may divert our attention.