Here’s how to add the most value to your home this Christmas

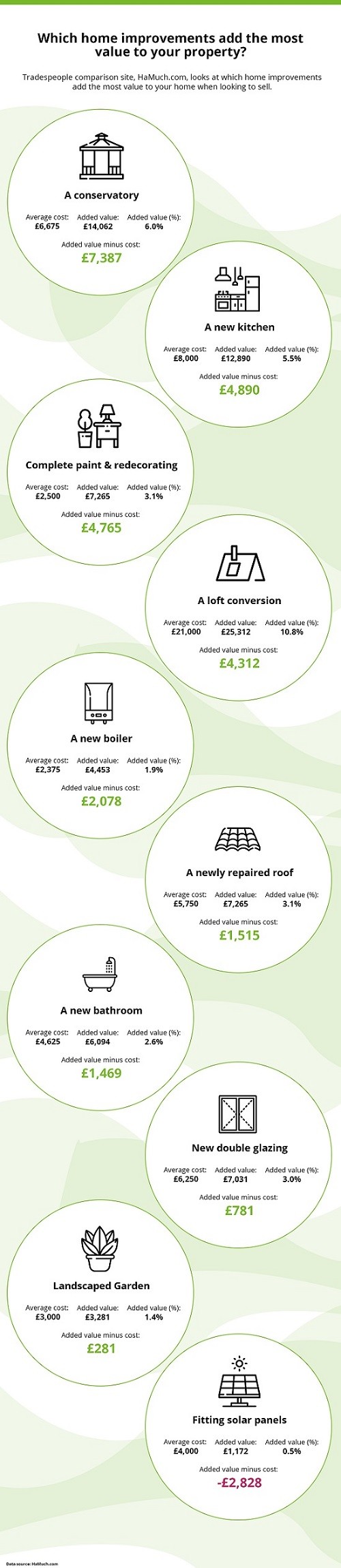

Adding a conservatory is the most cost-effective way of adding value to your property, research from tradespeople comparison site HaMuch.com has revealed.

Christmas can be a tough time to sell in a quieter market and ensuring your property stands out from the crowd can cost money.

HaMuch.com looked at the percentage value added by a number of home improvements on the average house once you’ve accounted for the cost of the work and found that installing a conservatory costs £6,675 but increases the price by £14,062, or 6.0%.

This means you increase the property value by £7,387 after factoring in the money spent on the installation.

Kitchen and all-over redecoration – good options

Other value-for-money home improvements you can make are installing a kitchen, adding £4,890 of value after taking costs into account.

Meanwhile conducting an all-over redecoration adds £4,765 to the house price after costs.

Loft conversions – a big difference

Converting your loft into a living area increases the property value by 10.8%, or £25,312, but it’s an expensive affair.

It’s estimated to cost £21,000 to carry out and you may need to gain planning permission, while there are practical barriers, as you may have to alter the roof structure, add windows and/or a staircase.

Solar panels – a slow burn

While solar panels may be environmentally friendly, it’s very much a slow burn in terms of getting value from them.

They cost £4,000 to install and only increase a property’s value by £1,172, or 0.5%,

Therefore savings with solar panels are generally limited to lowering your electricity bills.

Landscaped gardens – a negligible difference

Landscaping your garden makes little difference to the value of your home.

It only increases the value by £3,281 but the landscaping costs £3,000 – so you only gain £281.

Founder and CEO of HaMuch.com, Tarquin Purdie, commented:

“Revamping your property is a viable alternative to moving to a bigger home and you don’t have to worry about associated costs above and beyond the price of a job while moving will include other costs such as stamp duty.

Improving your home can also help increase its value in the event that you are looking to sell and adding a conservatory is the most cost-effective way of increasing your property’s value.

However, not every improvement will add value so it’s worth researching first, although if you want to make a guaranteed difference to your home’s value, a loft conversion is the way to go despite the high up-front costs.

Solar panels are the only improvement where you lose money in terms of adding immediate value, but if you aren’t looking to sell, you should be able to profit from lower electricity bills on a longer-term basis, and that’s not to mention the obvious environmental benefits.”

|

Renovation / improvement

|

Added value (%)

|

Estimated average cost

|

UK Average House Price

|

Added value (£)

|

Difference (Added value – cost)

|

|

Conservatory

|

6.0%

|

£6,675

|

£234,370

|

£14,062

|

£7,387

|

|

Kitchen

|

5.5%

|

£8,000

|

£234,370

|

£12,890

|

£4,890

|

|

All over re-decoration

|

3.1%

|

£2,500

|

£234,370

|

£7,265

|

£4,765

|

|

Loft conversion

|

10.8%

|

£21,000

|

£234,370

|

£25,312

|

£4,312

|

|

Boiler / central heating

|

1.9%

|

£2,375

|

£234,370

|

£4,453

|

£2,078

|

|

Roof

|

3.1%

|

£5,750

|

£234,370

|

£7,265

|

£1,515

|

|

Bathroom

|

2.6%

|

£4,625

|

£234,370

|

£6,094

|

£1,469

|

|

Double glazing

|

3.0%

|

£6,250

|

£234,370

|

£7,031

|

£781

|

|

Landscaped Garden

|

1.4%

|

£3,000

|

£234,370

|

£3,281

|

£281

|

|

Fitting solar panels

|

0.5%

|

£4,000

|

£234,370

|

£1,172

|

-£2,828

|