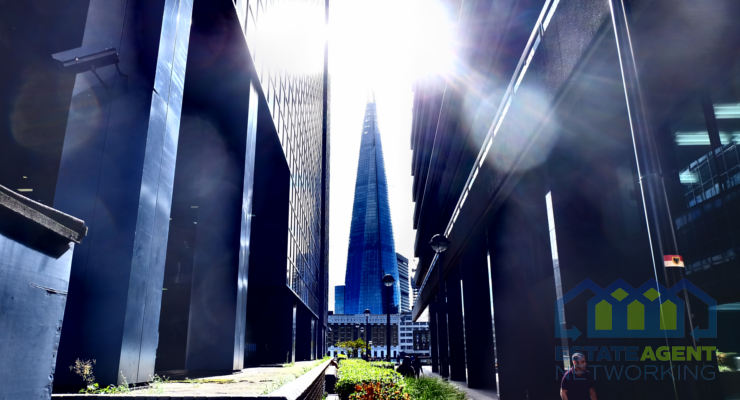

Prices are not plummeting in the capital and surrounds, but rather sliding gently according to Home.co.uk

Home.co.uk Asking Price Index report October 2017 released today headlines ‘House Prices Tick Up Despite London Falls.’

Top of the Home.co.uk headlines: Greater London prices slide for a third consecutive month, by 0.2%, pushing the year-on-year change into negative territory (-0.7%).

The drag effect of a weak London market means that the national average growth figure (3.2% YoY) weighs in at less than the rate of inflation as measured by the ONS (RPI ex housing) of 4.5% according to Home.co.uk.

Home.co.uk reveal that the most improved market over the last twelve months is the West Midlands, where Typical Time on Market has dropped by 12%. The South East stands out as the market that has slowed the most.

Doug Shephard, Director at Home.co.uk says: “Brexit or no Brexit, the London property market had to cool off. In fact, the process had begun long before the UK voted to leave the EU.

“Five years of massive house price inflation inevitably ended in the spring of 2016 with the beginning of the current corrective phase. Prices, of course, are not plummeting in the capital and surrounds, but rather sliding gently whilst monetary inflation does the rest.” more……

Read the Home.co.uk Asking Price Index report October 2017 in full click here.