Rant and Rave – What the heck is going on out there in property land?

Never mind ‘Lala Land’, what about ‘Lala Property Land’!

What the heck is going on out there in property land?

My rant: To our inner negative self-talk.

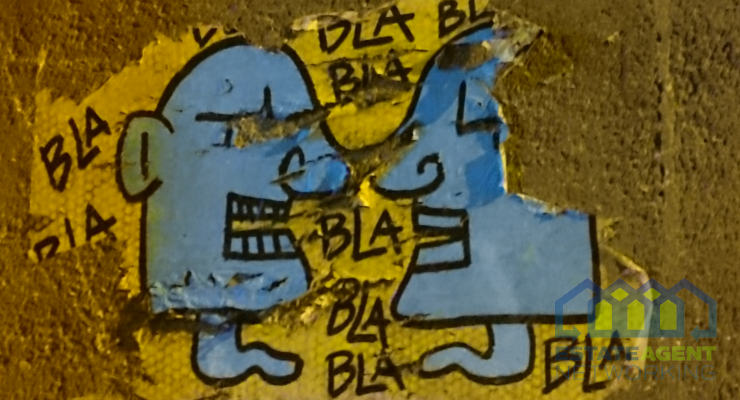

Lack of properties, lack of buyers, sad people, worried people, all going around in a zombie-like trance. Muttering ‘oh poor me’, ‘oh this is really bad’, ‘I blame stamp duty’, ‘ I blame Brexit’.

But wait right there, stop blaming externally and look inside. What’s all this negative inner self-talk? Is it really helping? Come on you know the answer? So why do we do it?

Brexit won’t be for another 2 years. Stamp duty is here to stay, for now. Yes, it needs to be changed, but it’s not. Yes, the industry has lost turnover, including us, but the world is not coming to an end. Certainly, the property market is not coming to end. People still need to live somewhere, they still need to buy. Interest rates are still at their lowest. Bank loans are at their highest since the crash. The UK are still in love with property. Yes, it’s hard, but then what if it was easy everyone would be an agent!! Let’s focus on what consumers want from us, rather than going in head down. Let’s go back to old fashioned agency, match the right buyer and seller and ensure it reaches completion. Still, 37% of sales fall through, so let’s improve that too. Surely, it’s going make us, and consumers, happier by practising positive self-talk, then all this negative stuff us humans love to bang on about.

My rave: To those who get it.

To the agents who are focusing on service, on helping the consumer and not focusing on the short term ‘quick fast buck’! I see loads of different owners, some don’t get it, and I don’t get why they don’t get it. Get it! But that’s their business and maybe they’ll be one of the 3000 who are predicted to go out of business over the next 5 years (that’s around a third of current agents).

But then I get pleasantly surprised by the many who do get it and are focusing on the today. After all, that’s all we have, that’s all we can change. The past is gone, the future is still to come.

Thank you for listening!

Blog by Avrillo