Rental Inflation Grinds to a Halt as Rent Controls Arrive in Scotland

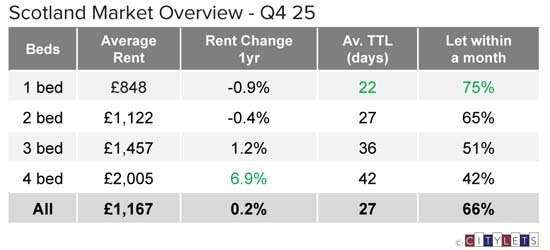

- Rental growth falls close to zero at just 0.2%

- Rents fall in real terms as new Act gives rise to controls

- Caution advised for future council market analyses

National rental growth falls to near zero as new rent control powers land in Scotland’s Private Rented Sector.

The latest Citylets report shows the rate of annual rental inflation collapsed from 4.4% at the start of the year to just 0.2% by year-end. The marked slowdown coincided with the debate over and passing of new rent controls under The Housing (Scotland) Act 2025.

“The timing is of more than passing interest”, noted Thomas Ashdown, Managing Director of Citylets, “Rental price inflation has been steadily cooling as affordability limits were reached and better market balance returned. Policy moved in one direction whilst the market moved decisively in the other.”

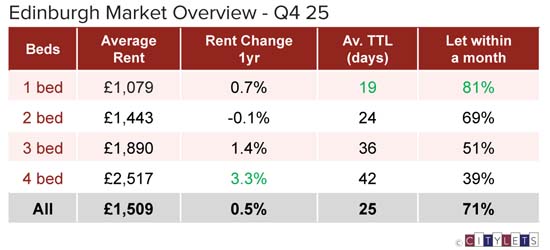

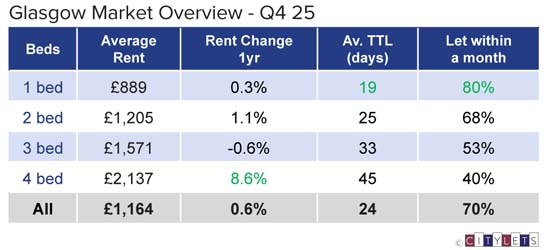

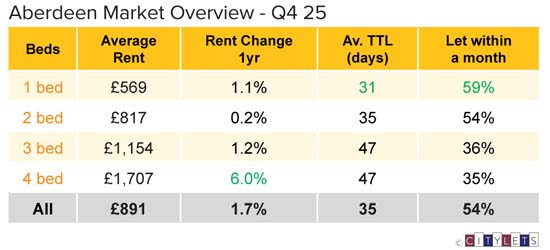

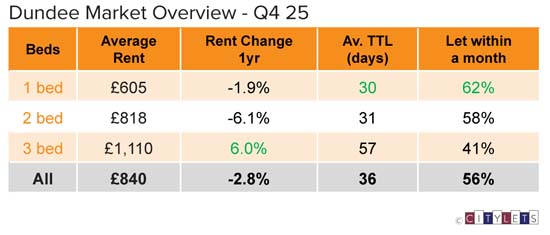

After years of sustained upward pressure, rents across Scotland’s major cities broadly remained steady throughout 2025, moving within a narrow range around zero with the exception of Dundee. Affordability, not excess demand, has become the dominant factor in rental growth.

The sea-change follows one of the most turbulent periods in Scottish PRS where rents on the open market rose rapidly in response to the dearth of supply which most observers attribute to the introduction of emergency legislation, which prohibited or limited the raising of rents within existing tenancies.

“What we are now currently at risk of”, continued Ashdown,“ is previous policy-led market anomaly potentially informing future policy. It is absolutely imperative that analyses put forward by councils for their local market conditions both recognises and mitigates for the data during that emergency legislation era.”

The passage of the Housing (Scotland) Bill came amid global economic instability, driven by abrupt US trade tariff shifts and persistent geopolitical disruption. UK macroeconomic conditions, however, supported the sector. Inflation fell steadily throughout 2025, while interest rates declined, delivering material relief to mortgaged landlords.

Commenting on the developments, Gillian Semmler, PR manager for Citylets said, “in a world of almost constant heightened uncertainty, a period of relative stability in the rental market would be a stabilising influence. Falling inflation, easing borrowing costs and a better balance between supply and demand have given the market a chance to breathe after years of extreme pressure.”