Traditional estate agents must embrace PropTech to survive

First-time buyers are struggling to get on the property ladder, house prices relative to incomes have rocketed (particularly in London and the South-East ), and the Brexit vote has caused additional uncertainty in the sector. With transactions in November 7.3% lower than they were a year ago, and the share prices of many leading estate agents falling, the uncomfortable truth is that it’s getting more and more difficult to be an estate agent.

If that isn’t enough, traditional estate agents face a further threat – the rise of the PropTech. Pitched as an ‘online vs. high street’ struggle by many in the industry media, 2016 was a good year for the PropTech. Causing many in the sector to become even more despondent.

But it doesn’t have to be that way. In 2017, the discussion we should be having is not “old vs. new”, but how we can combine our on and offline services to serve the consumer better.

The multi-channel estate agent is now crucial.

For today’s estate agents, while what happens in offices across the UK remains vital, your offline presence doesn’t exist in isolation.

Take a second to think about your own buying routine. You might see something in a newspaper, go online to find out more, and even ask your friends for recommendations before making a purchase; all before going into a shop to take a look at the merchandise for yourself.

Today’s buyers expect this level of interaction and information when making small, everyday purchases. So why wouldn’t they demand the same when it comes to making the most important buying decision of their life?

Canny estate agents understand that this multi-channel approach is not only desirable, but crucial. However, too many in the sector are simply paying lip service to the idea of multi-channel marketing.

In today’s increasingly digital age, listing properties on your agency website and Rightmove isn’t going to cut it long-term. Instead, you need to identify and deploy all the channels potential vendors and buyers will use when looking for an estate agent (bricks and mortar offices, listing websites, mobile apps, telephone sales, social media, etc.).

Taking this approach one step further, it’s no longer enough just to be seen online; you also have to provide customers with the best possible experience. Combining the very latest technology with excellent customer service – ultimately – to generate more sales.

How can traditional estate agents benefit from the rise of the PropTech?

In the face of such a fundamental change in buying patterns, any estate agents still using excuses not to innovate risk being left behind. Likewise, with an industry ripe for change, those that embrace disruption will lead the way and open their businesses to potential growth. But finding the budget and skills to develop and deliver an enhanced, proprietary online experience isn’t easy.

Enter the PropTech; a new business model with the ability to help estate agents make the most of this incredible opportunity.

Take Houseviz for example. Established as a PropTech a few years ago, having recently launched in the UK, we hope to revolutionise property marketing outsourcing over the next 12 months and beyond. But, rather than being at odds with traditional estate agents, we mean to do this by supplying them with the tools they need to win more business and sell more homes.

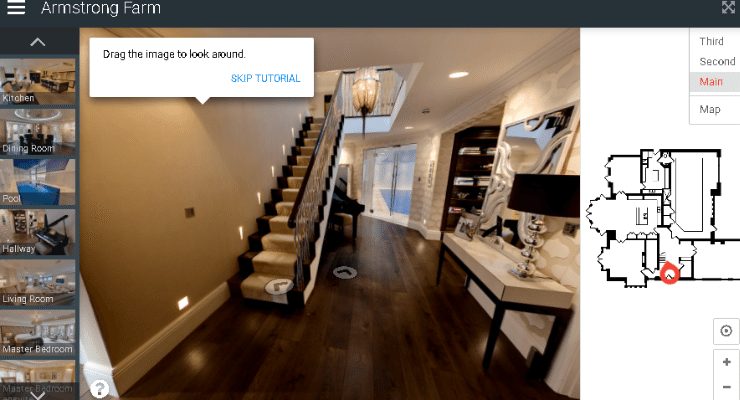

For instance, our new augmented reality (AR) selling tool (unique in the UK) combines floorplans, virtual tours, wide angle photography, and virtual reality. With an app and real-life marker, potential buyers can point their smart devices in an empty room to see how it would look with furniture. And, providing instant access to information about any properties a buyer is interested in, an app also delivers additional details via smart devices when looking at window displays, or viewing printed brochures.

Helping to create extraordinary experiences and content, we have also introduced a new range of VR services; including 3D virtual property walkthroughs, interactive floorplans, and VR point of sale kits.

With these services, not only are we giving the industry something new, we’re also making them affordable with a low-cost pricing structure. And, of course, we believe that the technology pays for itself by generating new sellers and sales. So, rather than a battle of “us vs. them”, we envisage a future where estate agents and PropTechs collaborate to help the property sector grow and flourish for the benefit of all.

Sponsored Blog Author: Amanda Lindsay – amanda@houseviz.com http://www.houseviz.com