Will House Prices Continue to Rise in 2022?

In more than a decade or so it appears that house prices have an impenetrable shield against any and all outside attacks be it from Brexit to the global drive of Covid19 lock downs and hits on the economy. Just when you think the news and current climate will suddenly cause a crack in the property market, it continues to drive forwards adding %’s to the average house price and the distance between first time buyers and their ability to walk over the threshold.

“Housing market has had the best start to a year in nearly two decades!“

Is it just all down to supply and demand? The population of the England continues to rise (currently at 55,550,000), approximately 250,000 to 350,000 added per year yet, this figure is somewhat higher then the approximate 200,000 to 250,000 new homes built each year. Though with the average household size in the UK is 2.4, then we can say the stock being built each year is more than adequate to cover the growing population. It would appear that in deed the supply is the issue that is not covering the demand, new builds will not accommodate all people’s requirements and it is the middle ground, middle class, of property that is scarce.

It the recent year or so of the covid19 situation we have seen city office workers given the chance to work from home which has fuelled the desire to leave the premium priced central urban locations to those property away from it all (London saw some decreases in house prices during covid19). The need to live next to main travel routes is replaced by a desire to have extra bedrooms, a small pad with low maintenance is not so appealing as a large gardens with your own veg plot and the ideal location goes from a stones throw away from the office to being that perfect rural / seaside location.

Rightmove themselves forecast an increase of property prices in 2022 with their feedback on the hectic market of the last 18 months:

“This is because we’re still seeing a huge number of home-hunters looking to move, and not enough homes available to buy, so the imbalance continues to push prices up.” source Rightmove

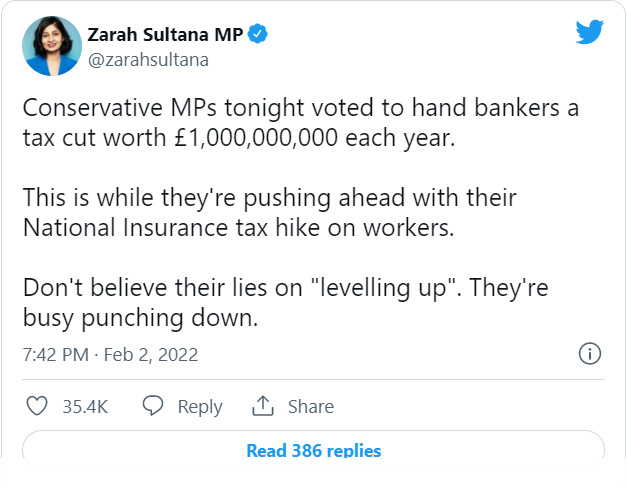

Zarah Sultana MP Tweet

Inflation and interest rates increases are in full swing now which could effect the house price index especially if the pinch is going to be felt by a growing volume of the population. The on going attack from the current government to punish everyday working people continues, the rich to get richer and the middle class to dissolve down to poor working class status. Fuel bills are forecasted to rise from around £1,250 to £2,000 annually yet Rushi Sunak has looked to hand bankers a multi-billion pound tax cut.

Councils buying up lower end housing stock for their private rental sector is also causing a lack of homes for sale especially at the lower end of the market. A further push against people owning their own homes (apartments to typical three bed semis) whereas we see a growing chronic shortage of larger properties.

My predictions for 2022 housing market in England:

There is much disdain for the current government from their handling of covid19 to illegal immigration, the prime minister has a more or less vote of no confidence from many. Yet those who could replace him, them from fellow conservative MP’s to the shadow government, do not leave people with any further optimism in fact probably less than the shower currently in charge. From changing of human rights acts to involvement in the so called conflict with Russia regarding Ukraine, there is a lot of tension and should patience wain from the paying public then we could see a dampener on the housing market especially urban locations. Higher demand, larger and better location property outside of prime city hotspots between £400,000 – £1,000,000 will survive and either maintain or increase in value.

If the chains of covid19 (despite a chalk and cheese approach across Europe) are released and it is back to business as usual then a mini boom could occur benefiting commercial real estate and certainly small to medium sized businesses. This will bolster the property market and give a small 5% year on year increase.

Further lock downs on future (predicted) strains of covid19 could see a collapse of small to medium sized businesses (especially if furlough is not re-introduced). This would cause an influx of defaults and thus repossessions so lower house prices and to what negative % will depend on the volumes hitting the market.

Summarise:

- Rural / Seaside location larger properties to increase

- First Time Buyer property to increase

- Premium city property to level

- Luxury City property to level/increase

Title image: Pixabay