How To Save Money When Renovating a House

Renovating a house can be one of the best ways to start a new life. You will be able to make your home feel more comfortable and increase the value of your property. That’s why you should not put this project aside and wait until your house falls apart.

If you are on a tight budget, learn these smalls tricks to avoid overpaying for your house remodel:

Setting a budget

It is necessary to have an exact plan before you hire a professional and start the home renovation. The thing is that you might end up spending a fortune if you don’t decide on a budget in the very beginning.

Make sure to write a list of priorities and calculate the costs of each room renovation. In some cases, it will be convenient to renovate a house step by step. For example, at first, you can redo your living room, then your kitchen and bathroom (the most costly project).

Reusing materials

Before you go to the shop to get renovation materials, look around your house. You might find some materials that you can reuse for free. It will not help you to save some money, but also zero waste can reduce your carbon footprint, which is good for the environment.

Hiring help smart

If you don’t want to pay twice for the service, make sure to hire professionals. Every skilled worker should have positive reviews from their previous clients, so make sure to check them before signing a contract.

Also, you might want to try doing some repairs in the house by yourself. These days, there are a lot of DIY tutorials on Youtube, so why not challenge yourself and save a few bucks?

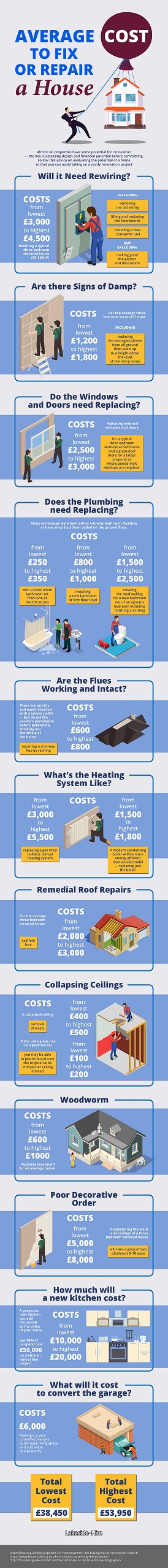

Would you like to learn about the cost of repairing the house in the UK? Check out the infographic provided by www.lakeside-hire.co.uk: