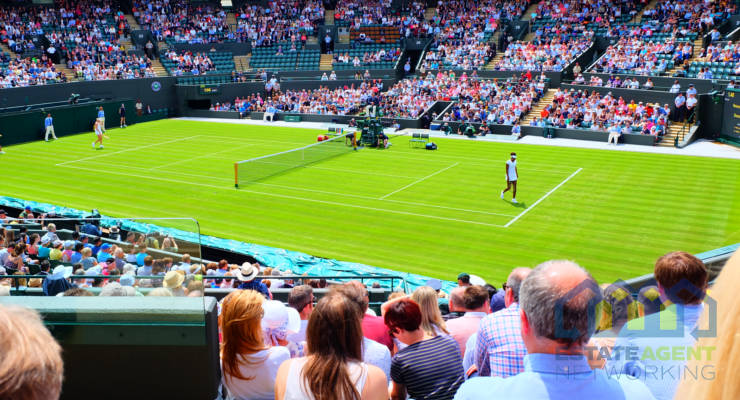

Wimbledon might be cancelled, but it still aces the competition on property prices

While many of us will have been gearing up for two weeks of tennis this weekend, London lettings and estate agent, Benham and Reeves, has looked at house prices around the now cancelled Wimbledon venue and how they compare to the other majors in the tennis calendar.

For the most affordable property within reaching distance of a major venue, tennis fans should head to Melbourne. Melbourne Park, home to the Australian Open, is also home to an average property price of £327,232 within the surrounding area. The area also represents the biggest bargain when compared to the wider city, with prices -20% lower than the Melbourne average.

The US Open is the next most affordable location for tennis fans, with the average house price surrounding Flushing Meadows Corona Park currently coming in at £474,099. Again, this is -10% more affordable than the average house price in New York City as a whole.

Across the 16th Arrondissement of Paris, home to the French Open, the current average house prices is a respectable £690,724, 4% higher than the average property price in Paris.

However, there is one clear winner when it comes to the cost of buying around a major tennis venue. The current average price of homes listed for sale in the Wimbledon SW19 postcode comes in just over the one million pound mark (£1,018,723).

Not only do Wimbledon property costs come in 47% higher than the 16th Arrondissement of Paris, but they’re also some 112% higher than the current London average.

|

Major

|

Location

|

Average house price

|

Average house price (in £)

|

Difference to Home City

|

|

|

Wimbledon

|

£1,018,723

|

£1,018,723

|

112%

|

||

|

£481,645

|

£481,645

|

||||

|

French Open

|

763,125 EUR

|

£690,724

|

4%

|

||

|

735,000 EUR

|

£665,267

|

||||

|

US Open

|

588,000 USD

|

£474,099

|

-10%

|

||

|

New York City

|

652,307 USD

|

£525,949

|

|||

|

Australian Open

|

590,000 AUS dollars

|

£327,232

|

-20%

|

||

|

Melbourne

|

706,000 AUS dollars

|

£391,569

|

|||