Posts by Allen Walkey

Should government provide deposits for ‘generation rent’?

A report published last week by Localis an independent think-tank dedicated to issues related to politics, public service reform and localism headlined ‘Turning Generation Rent into Homeowners’. The report makes the case for government to provide mortgage deposits for Generation Rent, it recommends the introduction of a government-backed deposit guarantee scheme for first-time buyers. The report…

Read MoreAldermore introduces new limited edition BTL product

Aldermore Group PLC the specialist lender and savings bank announced this week the launch of its lowest ever Buy-to-Let (BTL) product at 2.99% aimed at Private Landlords, for loans up to £1 million. The product applies to private individuals looking to either purchase or remortgage a buy-to-let property, and includes: 2.99% 5-year fixed rate up to…

Read MoreZPG invests in innovative proptech start-up

Zoopla Property Group (ZPG) announced yesterday that it has invested in and agreed an exclusive long-term strategic partnership with Bricklane.com, the UK’s latest innovative proptech start-up. Bricklane.com is launching the UK’s first online Property ISA, aiming to help ‘Generation Rent’ get a toehold in the property market whilst saving up for a deposit on a…

Read MoreInterest Rate unchanged at 0.25%

Bank of England Interest rate decision. Remains at unchanged 0.25% All 9 members of the Monetary Policy Committee voted in favour to keep interest rate on hold at 0.25% Bank of England Asset Purchase facility. Remains at £435B

Read MoreTrading update from Purplebricks

Purplebricks PLC issues a trading update for the 19 week period to 14 September 2016 in advance of its AGM to be held at 10.00am today. Commenting on the update, Michael Bruce, Chief Executive, said: “We continue to win market share through a combination of our compelling customer proposition, increased brand awareness and the ongoing…

Read MoreHouse purchase Lending for July down on June.

Press release published yesterday 14th September, from The Council of Mortgage Lenders (CML) headlined ‘July house purchase lending down 13% on June’. The report leads: Home-owners borrowed £10.6bn for house purchase, down 13% month-on-month and 12% year-on-year. They took out 58,100 loans, down 14% on June and 13% on July 2015. Paul Smee, director general of the…

Read MoreMajority continue to pay asking prices in rental market

Countrywide PLC Monthly Lettings Index August 2016 released early this week headlined ‘Central London sees fall in proportion of homes let above asking price’. According to Countrywide Lettings Index for August it shows that less people are paying above asking price to secure rental homes in Central London. Just 8% of homes were let at…

Read MoreHouse prices continue to rise post Brexit

UK House Price Index (HPI) for July 2016 released yesterday 13th September from The Land Registry. The July data shows an annual price increase of 8.3% which takes the average property value in the UK to £216,750. Monthly house prices rose by 0.4% since June 2016. The monthly index figure for the UK was 113.7.…

Read MoreHouse prices continued to grow in August

According to the LSL Property Services/ Acadata England & Wales House Price Index August 2016, average house prices now stand at £292,921 meaning the average homeowner is sitting on £12,101 more equity than this time last year. House prices continued to grow in August but at a slower rate than in previous months. Transaction levels…

Read MoreVoluntary Right to Buy scheme pilot launched

Housing association tenants are now becoming homeowners under the government’s extension of the right to buy scheme, a voluntary agreement between government and housing associations will give householders the opportunity to purchase their home under the new Voluntary Right to Buy scheme. The National Housing Federation has signed a deal with the government to offer…

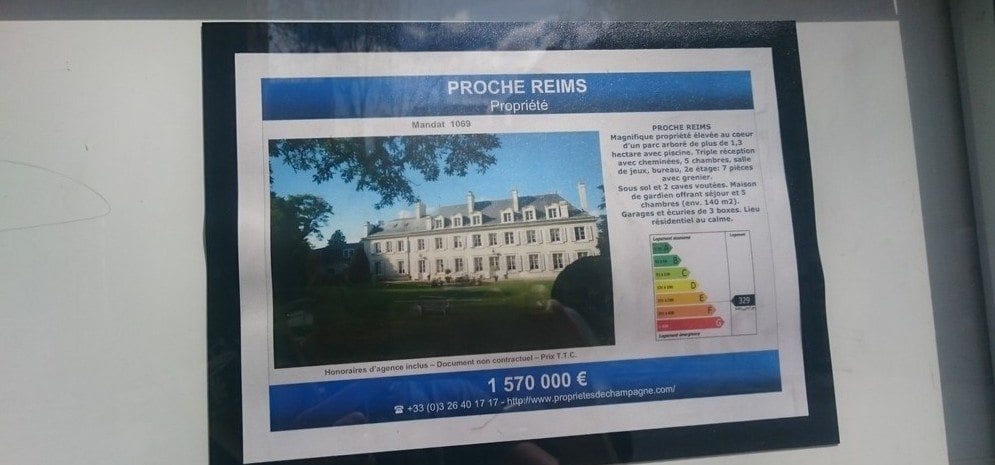

Read MoreFrench Property Exhibition at Olympia this weekend

The French Property Exhibition opens this weekend and runs for 3 days, 16-18th September at Olympia Central, London. The three-day event showcases thousands of properties for sale across all regions of France to suit every budget, and brings together estate agents as well as experts from the legal, financial, currency exchange and removals worlds. The…

Read MoreAverage rent in England and Wales continues to climb.

According to Your Move Buy to Let Index August 2016: The average rent in England and Wales now stands at £846 per calendar month, the highest figure ever recorded by Your Move. July’s figure is 5.2% higher than last July and 4.4% up on the £810 recorded in June 2016. South East sees rent increases…

Read MoreJuly Construction output growth flatlined

Figures published by the Office for National Statistics (ONS) showed that In July 2016, construction output was estimated to have shown no growth compared with June 2016. In July 2016, construction output was estimated to have shown no growth compared with June 2016. All new work increased by 0.5% while all repair and maintenance decreased…

Read MoreBorrowers gain confidence from Decisions made after Brexit vote

e.surv Chartered Surveyors mortgage monitor for July headline reads ‘Summer mortgage picture remains mixed for borrowers’. According to the latest Mortgage Monitor from e.surv, the UK’s largest residential chartered surveyor, found that 65,907 mortgage approvals (seasonally adjusted) were issued to buyers during the month. This is 4.9% lower than the number of approvals made in…

Read MoreHunters Property deliver strong results in H1

Hunters Property PLC one of the UK’s largest national sales and lettings estate agency and franchise businesses, yesterday announced its interim results for the six months ended 30 June 2016. On the operational front Hunters opened 17 new branches, expanding the branch network to 180. They acquired two further lettings books in the Manchester area…

Read More