Bradford real estate market: Rentals, sales and buy-to-let trends

Nestled in the rolling foothills of the Pennines, Bradford has a storied history as a hub of textile manufacturing. Though only a stone’s throw from Leeds, the city has a distinct feel, with charming Victorian-era architecture and a pedestrian-friendly core. Once part of the West Riding of Yorkshire, Bradford rose to prominence in the 19th century as an industrial centre, with historic mills and factories still dotting the cityscape today.

In recent years, millions of pounds have been invested to revitalise Bradford’s city centre and many of its heritage buildings have been lovingly restored. In response, both residents and visitors alike are being drawn to the city, which is having a noticeable impact on the property market.

In this article, discover everything you need to know about Bradford’s real estate market, from average rental prices to sales data and buy-to-let trends. It’s a useful resource for anyone looking to move to the city or invest in property.

Types of Bradford properties

Investing in Bradford property offers something for everyone. From luxury flats to cosy Victorian cottages, this diverse city has it all. Families can find spacious semi-detached and detached homes, while young professionals may opt for trendy loft apartments in converted warehouses. In Bradford, historic terraced houses with character abound, as do modern bungalows and executive homes.

Rental market in Bradford

Over the last few years, there has been an increased demand for rentals in the UK and Bradford is no exception. In 2023, the average price of a rental in Bradford was around £936 per calendar month while the median rent was £770 per month. The majority of properties available for rent were two-bedroom apartments and homes, with £800 being the average price paid by tenants. Three-bedroom properties were slightly more at just over £1,000 per month while one-bedroom apartments and studios averaged around £660.

For a four-bedroom property in Bradford, you can currently expect to pay around £1,340 per calendar month. A five-bedroom place will set you back around £2,250 per month. When it comes to property type, Bradford is split fairly evenly between houses and flats. As expected, renters can expect to pay more for a house (£980) compared to an apartment (£780).

For a better idea of current rental returns in Bradford, check out Rentola, which boasts the largest number of private property listings in the United Kingdom. It’s a convenient platform for both tenants and landlords alike, with its user-friendly interface making it easy to add a property to rent in Bradford. Simply create a listing description detailing the property’s main features and upload high-quality images for renters to view. Tenants can browse based on location, price and number of bedrooms, then contact landlords to arrange a viewing.

Property sale trends in Bradford

Home prices in Bradford have seen ups and downs over the past year. As of December 2023, the average price of a home in the city was £163,000, a fall of 12.6% over the last 12 months as sellers look to price more competitively. After a period of growth, there were monthly declines across all property types – detached, semi-detached, terraced houses and flats.

The majority of houses sold in Bradford over the last year were terraced properties, which went for an average of £139,447. For a bit more space or an expanded home, semi-detached properties sold for around £196,365. Detached homes (with no shared walls) fetched the highest prices, averaging around £339,000. At the cheapest end of the spectrum were flats, which sold for an average price of £127,600.

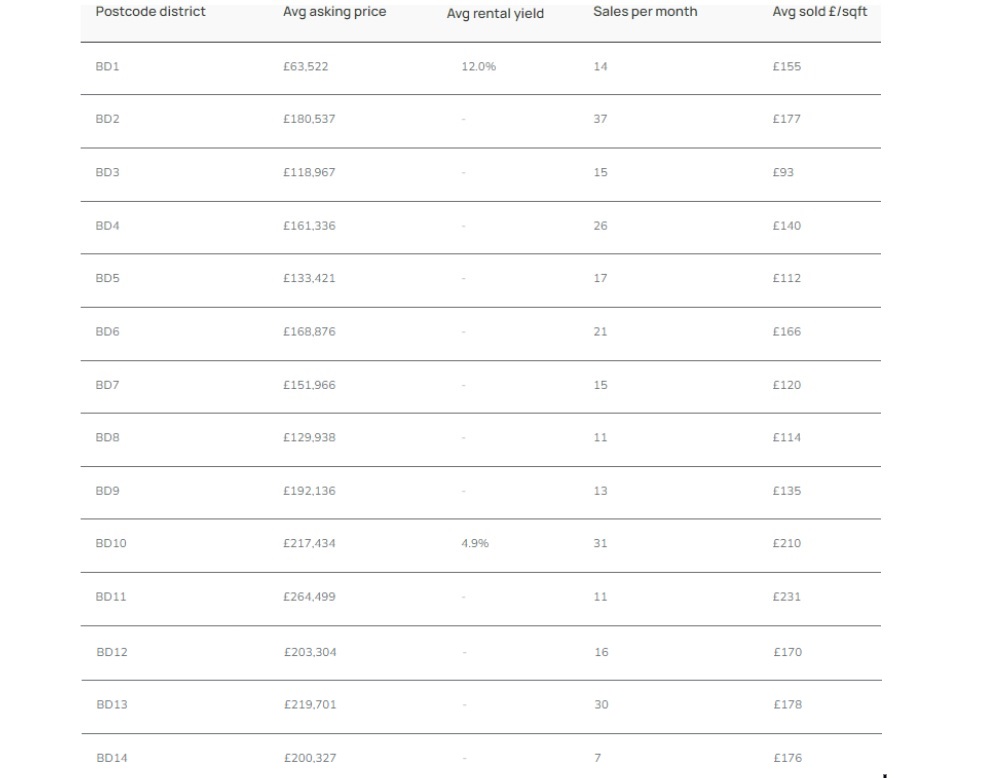

Source: propertydata

Source: propertydata

Compared to the UK property price average of £287,105, Bradford is still a relatively affordable place to buy a house. This is not only true for those buying a house or flat to live in but also for investors looking to transform their purchase into a rental property.

Buy-to-let trends in Bradford

With a strong economy, affordable real estate market and ongoing revitalisation, Bradford is an investor’s dream come true. For buy-to-let rentals, the city offers good yields in areas of strategic importance.

Most significant is Bradford City Centre, which offers impressive buy-to-let potential. With an average yield of just over 10%, it’s a prime location for profit. Beyond the affordable prices, Bradford City Centre is a smart choice due to its proximity to universities, transportation and community amenities.

Bradford’s bright future

For long-term rental income, Bradford has steadily delivered strong yields in recent years. And thanks to its new status as the UK’s first UNESCO City of Film, the city is emerging as a tourist destination. Savvy investors might want to consider short-term vacation rentals to capitalise on this flourishing market.

With its eclectic mix of property types and strong investment returns, Bradford is poised to deliver stable returns and growth opportunities well into the future.