Breaking Property News – 07/06/2023

Daily bite-sized proptech and property news in partnership with Proptech-X.

John Reynolds from Coadjute gives insight into the Property Data Trust Framework v2.0 and what it means for the property industry.

First published on the 23rd of May 2023, on the Coadjute Website.

Full disclosure, Coadjute are a client of my company Proptech-PR ‘A consulatancy for Proptech founders’ – but with my other hat on as owner of this publication it is very important that people in the property industry fully understand the seismic shift in how things are going to be done, and who is leading that charge. Here in his own words John Reynolds COO at Coadjute gives a great summation of a topic that a lot of people are talking about,

‘The Home Buying & Selling Technology Group (HB&SG) just unveiled v2.0 of the Property Data Trust Framework. What this announcement sets out are the key requirements for data providers, data users and trust entities to facilitate secure and seamless sharing of property data. As one of the main contributors to the open code base, Coadjute has had a significant role in this transformation.

We want to shed some light on exactly why this represents a significant milestone, and a step in the right direction for progress. What does this mean for the property market, and more importantly for those buying and selling homes?

Breaking down barriers

One of the major obstacles facing the property market in the UK has been the way its data has been stored and shared. An entanglement of overly complex processes, siloed systems, closed-off platforms and a lack of structured data and security standards has created an environment where data can rarely be shared in an easy or trustworthy way.

As a result, genuine progress and innovation has been stifled, and those trying to sell and buy their homes have been the ones to have suffered the most. Customer experience is at an all-time low, and we cannot expect buyers and sellers to put up with the situation getting any worse, or seeing transaction times get even longer than they already are, without urgent action.

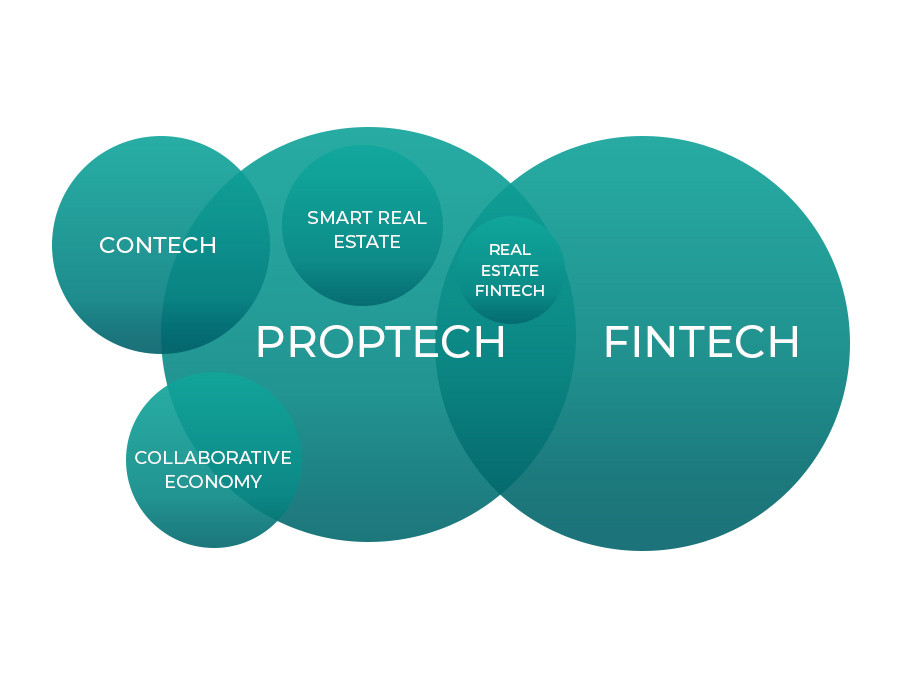

This is why the HB&SG’s announcement is so significant. The Property Data Trust Framework is all about breaking down those barriers in the industry, including siloed systems, closed platforms, and the lack of a trusted method to share data. In the same way that Open Banking sparked a transformation with FinTech, the way the Framework ensures the quality data pertinent to property transactions is more readily available, and easier to share, paves the way for a total revolution in Upfront Property Information.

Upfront property information reduces fall-throughs

The availability of quality upfront information has been proven to reduce fall-throughs. A recent pilot conducted in England showed transactions times reduced by to 53 days when more information was provided transparently and earlier in the transactions process.

By providing comprehensive, quality information about the property early in the process, buyers can make more informed decisions and have a clearer understanding of the property’s condition, potential issues, and suitability for their needs. This reduces the likelihood of unexpected discoveries or discrepancies arising later in the transaction, which are common causes of fall-throughs. Additionally, upfront information can help establish trust and transparency between buyers and sellers, promoting smoother and more successful transactions.

Why should I care?

But why – I hear you ask – should you as an estate agent care about implementing these changes? The reason is because there is a lot in it for you.

Implementing these changes can help you win more business as customers increasingly look for seamless digital experiences. The availability of upfront information has been proven to reduce fall-throughs, and with digital data driving the process instead of physical documents, transactions will complete faster. Now presents a golden opportunity to lead the change instead of following it.

Accelerating property transactions

Exciting times are ahead in the property transaction landscape, and at Coadjute, we’re thrilled to be at the forefront of this transformation. We’re playing a crucial part in shaping the future by providing Digital Upfront Property Packs, Digital Buyer and Seller Property Information (BASPI), and Smart Law Society Transaction Forms, all underpinned by secure, trusted data that flows seamlessly between businesses, and the software they use, during a property transaction.

Powering these advancements is the Property Data Trust Framework, our Distributed Ledger Technology (DLT) network, and the growing connection of estate agents, conveyancers, and brokers to our network. With the open Coadjute network, the benefits and value of open data are exponential.

Coadjute is proud to have been a main contributor of code to this open-source project and we’re excited about the improvements it brings to the industry. Join us as we help shape a better future for property transactions’.

Who is winning the Proptech distribution race?

Having worked with over 120 Proptech founder clients, their biggest headache is distribution of their service. They get to market fit with their Saas, now they need paying users in volume. The problem like electric cars is that the infrastructure in not in place for a national roll out. As with the cars needing a charging point everywhere, getting software solutions into say estate agents is a real slog.

The landscape though post Covid is changing as digital is finally getting its tendrils into everything, and with everyone realising that technology can actually make things quicker and cheaper to run operations. At the same time there has been a rise in the way that Proptech solutions can be accessed by property professionals, the big question is which route will be the winner.

Traditionally Proptechs engaged a sale team to sell their services, this is costly and the sales cycles are long and expensive. Now there are opening up well established other ways for property technology to get inside the businesses that really need them.

One way is for the property portals to either buy or do a business partnership with a Proptech supplier, piggybacking the portal’s sales team and brand, or with an exit, becoming part of that brand. An example Yourkeys and its exit to Zoopla. Or as Jason Tebb has been doing so actively with a number of super brands like Sprift.

Another way is CRM integration, this is a trusted pathway to agents, Reapit with Foundations, Alto just announcing integrations with a clutch of Proptechs.

The third way for Proptechs to get into the agent nexus is via agency organisations, I am a NED of nurtur.accelerator, underpinned by Jon Cookes Guild and Fine & Country group. Nathan Emmerson’s Propertymark are tied in with REACH UK, which I mentor for, and Graham Lock at the FIA has a healthy interest in helping his membership use the best in class.

There are also big beasts like iamproperty who are tearing up the landscape a business with two modernists looking to help agents become more profitable. In my view in five years there will probably be one main route to market for Proptech players in the UK looking to service agents, at the moment it is an open field with many players jostling for position.

If you have a view – please let us all know by emailing me at editor@estateagentnetworking.co.uk – Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X