BREAKING PROPERTY NEWS – 27/10/2021

Daily bite-sized proptech and property news in partnership with Proptech-X.

New analysis shows online agents are on the ropes

TwentyCi, a provider of customer intelligence and consumer data, has shown that non-traditional agents – online and hybrid agents, typically with no physical office – now account for 8.3% of the housing market. Stripping out just the online agent data, it would seem they hold around 6% of the market.

Are we seeing a resurgence of online agents? The answer is a resounding no, because the top three online agents in real terms never make a profit, so it is shareholders buying the market.

To put it in perspective, the top three online brands are Purplebricks, YOPA and Strike. On paper, Purplebricks announced its first profit of £6.8 million in April 2021, but part of that figure was £2.2 million for selling off a related business in Canada.

Last year it lost £19 million, and the year before that £54.9 million, then £30.08 million the year before that and £3.01 million before that – so, all told, £107.1 million in losses. It kept going only by the good graces of the public and corporate investment piling in to keep the company solvent.

YOPA made losses of £17.8 million in 2019, and losses of £30 million in 2018, and we have yet to find out its profit and loss for last year as the accounting period has been extended. But, since its inception, over £65 million of investment has been pumped in to keep it afloat.

Strike made losses of £26 million and £18 million in the last two accounting periods and has burnt through over £60 million of investors cash to keep solvent.

Looking ahead, the slim profit made by Purplebricks may well go into the red as it is now ‘employing’ all of its ‘workers’ which will add an extra burden to its P&L. Also it may face a class action from former ‘workers’ looking for recompense, as they may have in fact been employed all along.

When the backers of YOPA or Strike call it a day and refuse to support the multi-million losses by throwing millions of further investment into a lost cause, the online agents will close their digital doors.

For Purplebricks, which is listed on the AIM and has a major shareholding by Axel Springer, the German publishing group, the story may play out differently. There may be a pivot in the model.

One of the most stunning facts is that the online agents have a very small number of employees; one, for instance, has fewer than 150 and yet it still turns in a multi-million loss. How can this be? Especially as there are no physical offices, rents, rates, utilities and other commercial costs, the reason, the outrageously high cost of the capture of new clients and the huge digital and marketing spend to keep the brand in peoples’ minds.

As TwentyCi put it in their analysis: “With many sectors and categories having seen a significant shift online during the pandemic the estate agency sector has not followed suit with a relatively low and slow rate of growth persisting.”

My thoughts are that the public does want a choice that is an alternative to the slow, paper-based traditional agents, but it is time to go back to the drawing board and build an online model that utilises the technology of 2025 and does property in a modern way, not badly replicate the traditional style of agency that prevails at present.

Zoopla announces strongest housing market for 14 years

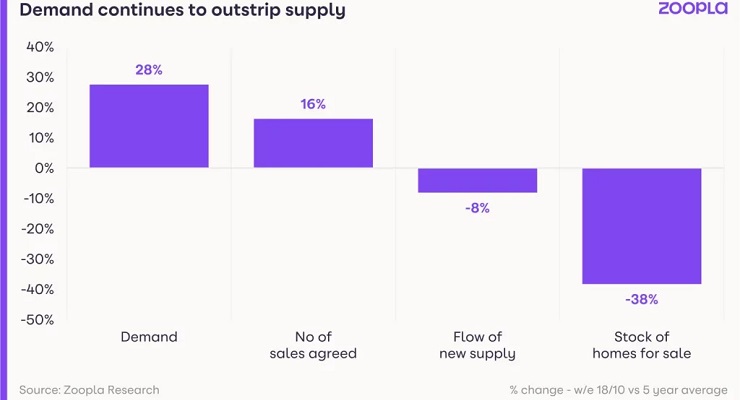

Demand outstrips supply | Source: Zoopla

Zoopla, the second-largest property portal has announced in its most recent analysis that it expects the HMLR will show that 1.5 million people bought a property in 2021. This is significant, as typically in recent years the figure has been nearer the one million mark. A marked uptick in movers.

The pandemic and remote working, plus of course the SDLT holiday, has meant that buyers and sellers have been very active. In a piece written for Zoopla by Nicky Burridge, further detail is fleshed out on what may be ahead in 2022:

Key Takeaways

22% of people currently want to move, significantly higher than the usual 5% in a normal market

Annual house price growth was 6.6% at the end of September but is expected to slow to 3% in 2022

Nicky Burridge also said: “The end of the stamp duty holiday has failed to dampen demand from potential buyers, which is up 30% on the five-year average. Thanks to the tapering-off period at the end of the holiday, the anticipated ‘cliff edge’ is nowhere to be seen and the pandemic-induced boom still has further to run. Homes collectively worth £473 billion will be sold this year, that’s up £95 billion on the number of offers accepted in 2020.

“However, the level of activity is expected to slow next year as the market faces a number of headwinds.”

Adding to this analysis, Richard Donnell, executive director of Zoopla said: “The impact of the pandemic on the housing market has further to run but at a less frenetic pace. We expect the momentum in the market to outweigh some emerging headwinds from higher living costs and the risk of higher mortgage rates.

“The latest data shows a turning point in the rate of house price growth, which we expect to slow quickly with average UK house prices up 3% by the end of 2022.”