Breaking Property News – 29/03/24

Daily bite-sized proptech and property news in partnership with Proptech-X.

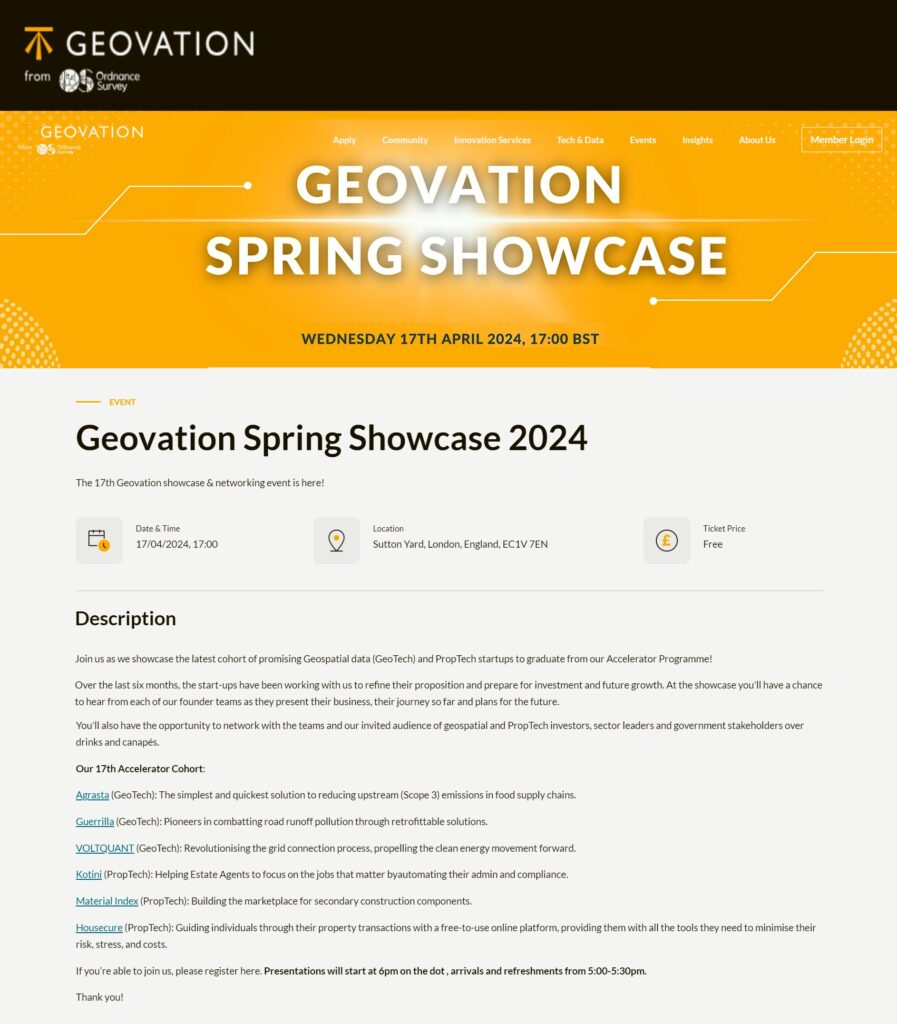

Geovation Spring showcase – why it is important that you come and support the founders

The event takes place on the evening of Wednesday the 17th of April, at Sutton Yard, London EC1V 7EN, please get it booked into your diary today.

As ever the Geovation program has supported and found the very best in talent and innovation and it will be a great evening to mix and network with new and old freinds as well of course with the founders, also for anyone thinking about getting onboard with Geovation as a growth partner to their ambitions, it is a great night to explore what that might look like.

Over the past seven years I have been involved with and been an advocate for nearly forty different startup accelerators, scaleups and other programs that help founders on what is often a hard and relentless journey from hopefully mvp to exit.

The value of having organisations like Geovation can not be stated enough and aside from the funding and the use of data, the community and of course all the team involved and the mentors really does cut years off the runway to success. Please join in and support these founders as they now start the nexy stage of there journey.

Maria Harris Chair of OPDA calls for the availability of trusted property data to be speeded up

Maria Harris shares the fact that the property market is up by 9% in terms of activity against the previous point last year, but feels strongly that the whole marketplace could flow much quicker if all the siloed data was shared by all and was in a trusted and workable format. Just as open banking led to the rise of a vast number of useful new services, the thinking is that if the property industry really understood itself by unlocking all the data, then all stakeholders would benefit.

At present 99% of all that data is not in the public domain, which amongst other things makes it very expensive for technology founders to build new services and the whole industry to digitally transform.

Maria Harris, Chair of the Open Property Data Association, says: “February’s rise in residential transactions is an encouraging sign of recovery. It’s a busy time for the home-moving market, with rate changes and market updates coming at dizzying pace. Having a well-functioning home buying market has never been more important, so it’s encouraging to see the Levelling Up Select Committee inquiry on improving the process and the Law Society embracing upfront material information.

Currently, less than one per cent of property data is available in an open, trustable, or shareable format. It’s essential that we fix these foundations and infrastructure through open data standards and trust frameworks before we can digitise the homebuying process and give consumers the transparency and ease of transaction they deserve.”

The provisional non-seasonally adjusted estimate of the number of UK residential transactions in February 2024 is 73,360, 3% lower than February 2023 and 9% higher than January 2024.

Andrew Stanton Executive Editor – moving property and proptech forward. PropTech-X