Has London Benefited from Online Estate Agents?

Online estate agents seem to have taken the United Kingdom by storm, with many homeowners in the nation making the switch from high street to online agent. This is most evident in estate agency royalty, Savills, recent investment in online estate agent startup YOPA. The minority stake purchased by Savills is testament to the potential in this rising industry, as a true veteran in the field has invested into a direct competitor of their own company.

While the Savills procurement is a great example of potential, it does not show the current benefit that online estate agents have on the property selling market, if any. The plastering of Tepilo, PurpleBricks and HouseSimple adverts up and down the country, always tell the tale of the infinite savings, ease of use and flexibility customers can gain by using their platforms. How much of this is true? More importantly, how much of this is true for our Londoners? The London property market is responsible for a hefty number of property sales in the UK, meaning that these online estate agents should have created options to appease our beloved London residents.

Variety

Variety is the spice of life. However too many options can just become overwhelming and confusing. The introduction of online estate agents has offered a nice alternative to high street agents, with competitive pricing and an innovative process, it’s refreshing to see some healthy competition against the traditional agents. However, as with any new field, there isn’t just one top player, there are several. With the emergence of online estate agents, there came numerous competitors in the field. So much so that when considering an online estate agent it is difficult to know where to start, the different business models and price points can all be somewhat perplexing.

However it seems that our intelligent Londoners have embraced rather than opposed the diversity. Nearly 3000 unique searches are made each month for the term “online estate agents” just from the London area alone, not only this, several thousand users have registered to our online estate agency, CastleSmart for either selling or buying purposes. The major traction from London shows the want and maybe need for the service that online estate agents offer.

Savings

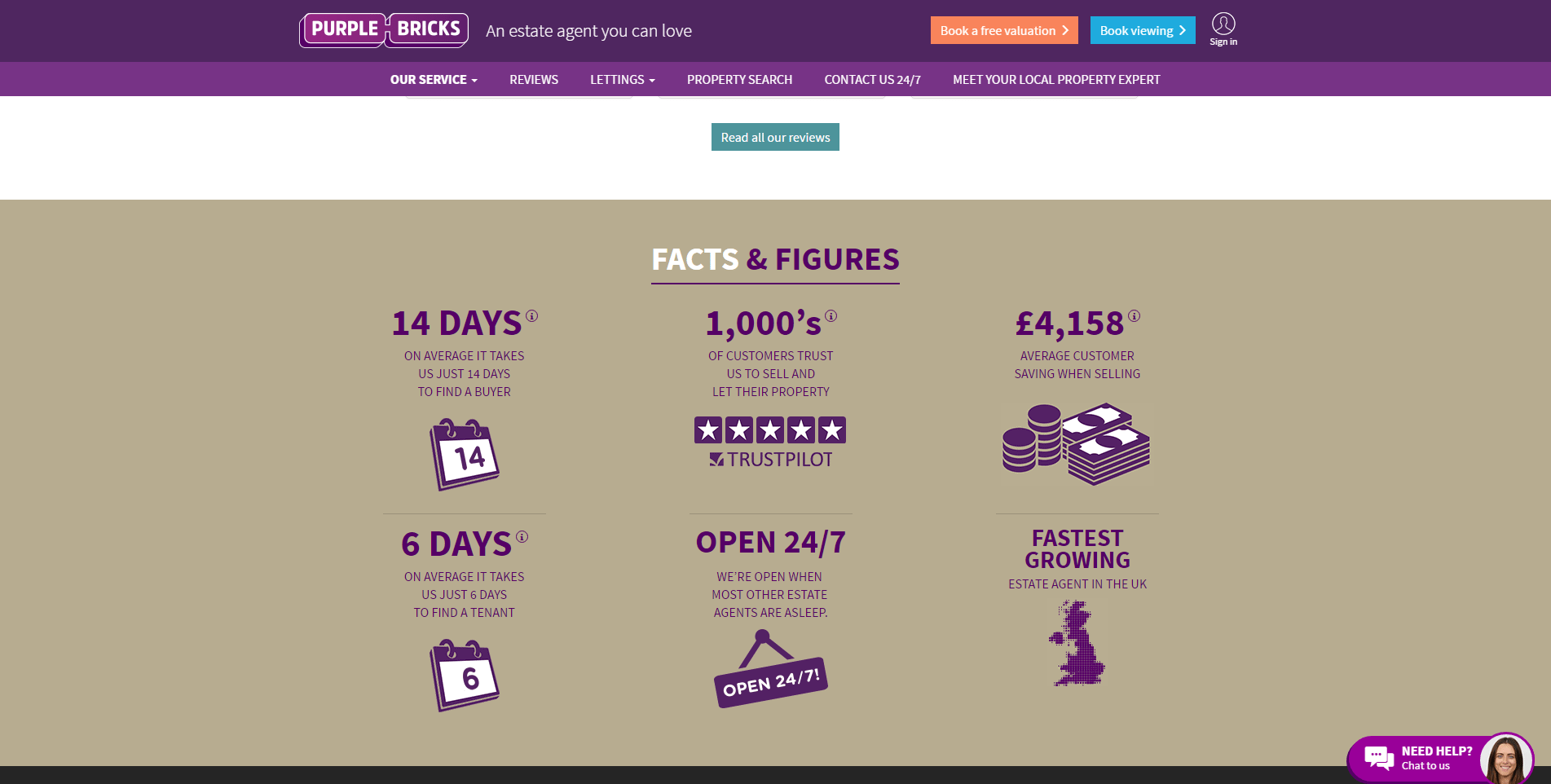

The unique selling point of each and every online estate agent out available; their savings. Nearly all adverts will brandish in big bold lettering “Save XXX amount using our service”, while this is a great statement to make, how much of this is true? Here at CastleSmart our cheapest package will see a customer saving £7000 on a £500,000 home with the high street agent taking a 1.5% commission.However, PurpleBricks, arguably the largest online estate agent in town only offer an approximate saving of £6,500 exclusively for London customers when considering the same criteria. While this a large jump from the aforementioned savings it’s still thousands in savings, something that cannot be argued against.

Sales

If you weren’t aware, the business model for most online estate agents is a fixed price fee. Meaning that the seller pays an amount up front and their property listed on the market, the only flaw in this model when compared to traditional estate agents is that you’re still paying regardless if your property sells or not. This is major difference between the traditional and online business and also the cause of deterrence from the online option. A sale may not be guaranteed, but that does not mean that they do not happen as both agents do essentially the same thing. Properties nowadays are found online, not by contacting estate agents, meaning that it is the agent’s responsibility to make sure your homes can be found on all major property platforms (which is the service that traditional and online agents alike offer).

With this in mind, do Londoners successfully sell their properties via online estate agents? After speaking with a PurpleBricks representative they stated they currently have “795 properties on the market in London” and “300 have sold recently” although unable to give an exact time frame for “recently”. Now, this comparatively to the amount of properties that are sold in London on a monthly basis is just a splash in the water, but it does provide evidence that properties can and are being successfully sold in London via online estate agents.

Availability and Comfort

The hustle and bustle in London can sometimes be intimidating and but important extremely time consuming. If you observe the average Central London employee, their frantic pace makes it seem as though there isn’t enough time in the day. And there probably isn’t. It seems the online estate agent industry has seen this and answered the busy home sellers prayers. The online agents pride themselves in creating platforms that are not only cheaper than the traditional kind, but much more convenient to use. For example CastleSmart boasts a simple four step process to list your property on the market, which in a total run time takes approximately 10 minutes. As you can imagine this a considerably shorter than visiting an estate agents office and also provides the comfort of your own home.

Speed is not the only item in the online agent convenience package, it also bolsters availability. Your average real estate agent will available from the hours of 9 to 5, after which time you’ll have a hard time getting hold of them. Juxtaposed to this, most online estate agents offer 24/7 availability, allowing you to list your property on the market any time of the day.

Conclusion

Yes, it’s fair to say Londoners have undoubtedly benefited from the launch of online estate agents. They’ve flocked in their thousands to give their services a try and the results have been extremely positive. While we’re way’s away from a complete transition to the online agent, they’re definitely here to stay.