Nestapple Intro

NestApple is paying back to clients the commission that realtors usually keep for themselves

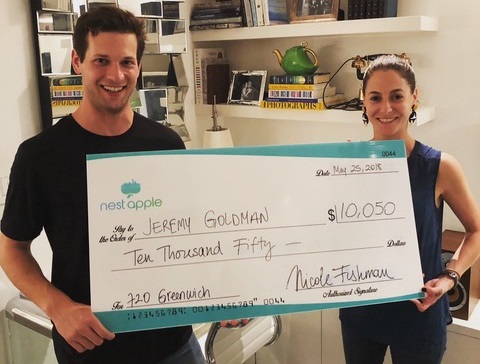

New York – New York-based next-generation real estate technology and brokerage firm NestApple is offering home buyers the opportunity to earn a 2% rebate check of the sale price.

NestApple founders, Georges and Nicole Fishman Benoliel are long-time real estate investors in New York City. After going through the lengthy and costly process several times, they grew increasingly uneasy about the outdated system. While most segments of the economy have evolved due to innovation, real estate still operates in an antiquated manner that dates back from the 1980s. While websites like Streeteasy or Trulia make it easier than ever to search for homes and find comps, nothing has changed in the way people buy and sell real estate.

In an increasingly transparent market, there is less value in what traditional brokers offer. “The market has never been so transparent”, says Georges Benoliel, “all the information is available online, two clicks are all it takes to know what your neighbor paid for his apartment or whether he took a mortgage”. “The role of realtors needs to evolve and adapt” adds Nicole. While searching for ways to bypass the system, Georges and Nicole stumbled upon the concept of commission rebates which are legal in 40 States according to the Department of Justice and have in fact been publicly encouraged by New York’s Attorney General.

Real estate fees are too high

Real estate fees in the U.S. and New York especially are considerably higher than in Europe and represent 5 to 6% of the sale price. This percentage is then split evenly between the seller’s agent and the buyer’s agent (2.5% to 3% for each), if not, seller’s agent receives the entire commission. NestApple is listening to the market. While some brokers sometimes give small discounts, a vast majority of them will not decrease their commission structure. NestApple pays back 2% to the buyer at closing which averages $22,000.

Benefits for buyers

NestApple is a licensed brokerage with an efficient platform that assists clients in placing a bid all the way through closing the deal and everything in between.

NestApple’s founders believe buyers can look up properties themselves; all the information is available online and all you need is a guiding hand and experienced agent to assist you in pricing and negotiating. The role of brokers has changed and so should the commission they receive. “Our goal is to bring sellers and buyers together in a more efficient way, and pass the savings onto our clients”, says Nicole Fishman Benoliel.

Social responsibility

NestApple is joining The South Bronx Educational Foundation to foster the development of young kids in the Bronx. Every time NestApple closes a deal, the company makes a donation to finance a mentoring program for a kid. As Georges and Nicole believe in the corporate responsibility of entrepreneurs and that businesses should play a role in social innovation and engage the local community. “Our partnership with SBEF allows us to give back and create a sense of community in our city”, concludes Nicole.

Contacts:

Georges Benoliel, CEO

info@nestapple.com

1-855-NESTAPPLE