New Research Reveals Properties In The UK Sold For £10,000 Greater Than The Original Asking Price

New research from TwentyEA reveals that over the last 12 months, properties across the UK achieved an average selling price of 2.5% above the original instruction price, giving vendors an extra £10,000.

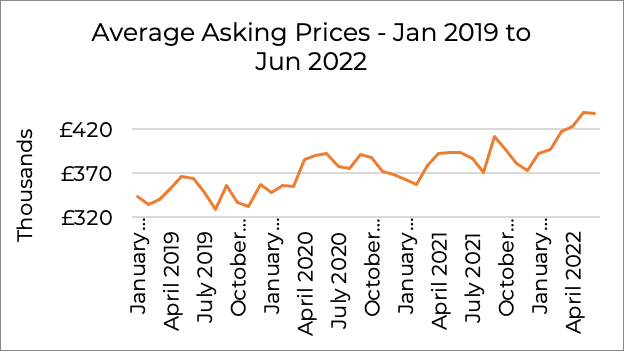

TwenyEA’s latest property price data for June 2022 shows that the average price of a home has hit £400,000. The market does not appear to be slowing down, despite homeowners facing increased pressure on their finances, thanks to the cost of living crisis.

Properties in the South West remain popular with home buyers, showing the strongest rates of house price growth over the last 12 months, with asking prices sitting at 18.24%, while growth in inner London is lagging, with the slowest rate of growth at 7.9%.

Wales is seeing the second highest asking price growth at 17.64%, followed by the West Midlands at 16.48% and the North East at 16.4%.

TwentyEA: Asking Prices Year on Year

| UK Region | Initial Asking Price June 2022 | Initial Asking Price June 2021 | Percentage Increase |

| East Midlands | £317,188 | £279,468 | 13.5% |

| East of England | £465,324 | £417,575 | 11.43% |

| Inner London | £980,375 | £908,706 | 7.9% |

| North East | £214,044 | £183,955 | 16.4% |

| North West | £283,459 | £244,208 | 16.07% |

| Northern Ireland | £199,556 | £177,586 | 12.37% |

| Outer London | £593,217 | £539,700 | 9.91% |

| Scotland | £233,236 | £211,325 | 10.4% |

| South East | £553,223 | £482,512 | 14.7% |

| South West | £447,479 | £378,463 | 18.24% |

| Wales | £299,183 | £254,324 | 17.64% |

| West Midlands | £337,768 | £289,979 | 16.48% |

| Yorlshire & The Humber | £275,967 | £239,981 | 15% |

The research shows that asking prices have risen by an average of 11% over the last 12 months and by 20% since 2019.

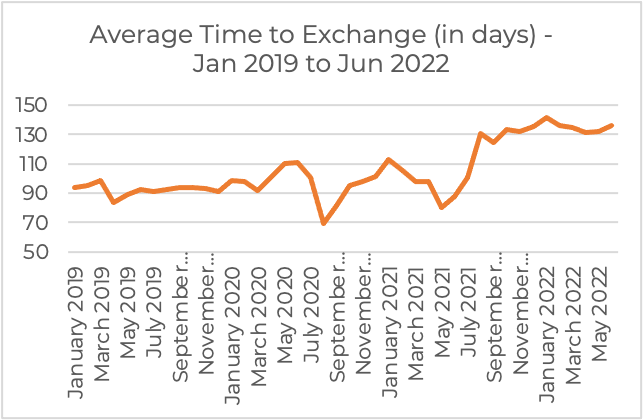

The TwentyEA research also reveals that average time to exchange on a property has risen dramatically, with June 2022 figures showing it is sitting at 136 days (4.5 months), 47% higher than the 92 days in June 2019. The time to exchange is measured by the lag in days between the last sale agreed date and the exchanged date.

Stuart Ducker, Strategic Solutions Director of TwentyEA comments: “Our analysis shows that despite soaring inflation and interest rate increases, property prices are still rising across the UK, with eight regions of the UK experiencing year on year asking price increases of more than 13%.

“While rising prices are good news for vendors, the average time to exchange is taking much longer, due to the lack of supply and delays in the chain forming. If vendors get a sale agreed on their property, it takes much longer to find somewhere they want to live.”

TwentyEA are experts in the UK home mover market, providing smart, specific and intelligent home mover data and insight to help agents better understand the challenges of the industry – and crucially how to apply this knowledge to leverage brand power.

TwentyEA holds the UK’s biggest and richest resource of factual life event data including the largest, most comprehensive source of home mover data compiled from more than 29 billion qualified data points.

TwentyEA’s customer intelligence and engagement solutions leverage data and technology on agent’s behalf, enabling them to connect with target consumers using unique data insights into the key life events that stimulate customer demand.

TwentyEA is part of the TwentyCi group of companies who use data science to improve commercial outcomes for clients.

For further information please visit https://news.twentyea.co.uk or email enquiries@twentyea.co.uk.