Who do you think you are? Russell Quirk of eMoov answers:

January 19, 2017

You are not too worried about ruffling a few feathers in the industry, it is not uncommon to see your comments towards the UK Estate Agency industry receive a backlash from within the industry. Happy with that?

Any business or business leader that is pioneering something as part of changing something old and broken, is bound to be derided. There’s a misconception that I court such responses, which I don’t. What tends to happen is that a tweets or a press release is sprung upon by opportunists in the industry that perhaps believe, a little naively, that scoring a quick point by skewing something out of context somehow ‘corrects’ the advance of the online/hybrid estate agency model. I’m deeply misunderstood actually but if I’ve become the whipping post for the estate agency traditionalists, that’s ok and I’ll just have to contemplate coming to terms with the anxiety from the deck of the yacht that I’m going to buy when the job’s done 😉

I do not need to hold any qualifications or dare I say qualities to become an online estate agent or an agent working under eMoov?

Qualifications? I’m not sure that any proper qualifications to be an estate agent even exist do they? And I’m not counting the NAEA exam (which I took and passed) which was as much about knowing where the first aid box was located as it was knowing the principles of the Estate Agency Act.

I’ve stood up and called for licensing of estate agents and I believe that this must be implemented as legislation for all individuals and firms engaged in estate agency. Frankly, the number of high street agents regularly plastered across the press for stealing, defrauding, non-compliance and worse, should make us all want to see higher standards and not just in compliance terms but where knowledge of the moving process is concerned.

As for our qualities, our customers rather embrace those and the accolade of being rated the number one estate agent (by customers, not a dusty room full of estate agents) of all 26,000 UK branches at AllAgents.co.uk, is worth far more to me and my team than a certificate on the wall.

You boasted about be front page of Daily Express with your thoughts on the UK property market. This is the Daily Express though, the usual ‘House Prices Up’ or ‘House Prices Down’, ‘New Coldest Winter Ahead be Prepared’ and normally typically Far Left headlines! LBC seems to like you also!

Hey, I’m simply very likeable I guess. eMoov has become known for its press coverage and we’ve got better and better at it since I took it in-house and started to personally oversee it. The mission is to gain brand awareness of course but also to ensure that the public can be confident that they are dealing with knowledgeable experts. Our PR achieves phenomenal results (3500 mentions in 2016) and it provides a hugely more efficient ROI than chucking millions of pounds at ads on TV and on tube carriages.

Online Estate Agents / Hybrid Estate Agents – Can we throw them in the same pot?

There is distinction and so no, not really. Online is in my assessment, the companies that want to digitise the whole process from start to finish with no people involved at the agency end. The temptation is to try to advance that business model because it’s cheaper to run. But what we’ve seen from those that believe in this approach is poor technology execution and really, really bad customer service of late (you know who you are). The customer is not ready to go from total analogue to total digital, in my view. It’s a balance that’s needed and that’s where the hybrid comes in….

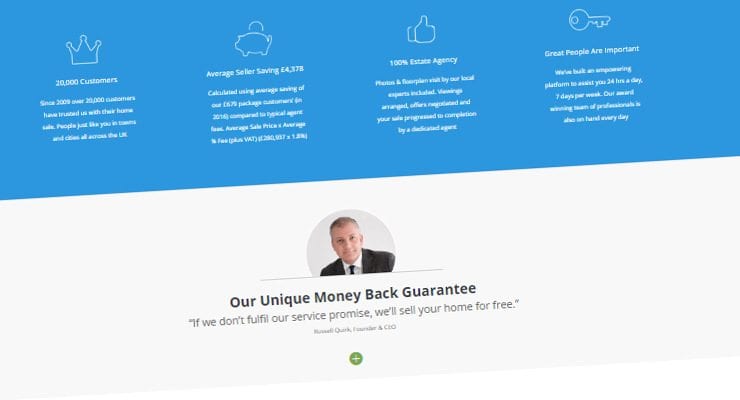

We are, if you insist on a label (I shun them really but let me humour you for a sec), a hybrid in that we visit the home to provide free valuations and to pitch our service. But we are very different to the other competitors in the space in that we utilise a team of customer support agents as well as specialised negotiators to do the sensitive stuff around offer negotiation, buyer qualification and sales progression from offer to completion. Some in our sector say that they do this too but there’s only one or two that actually do. Unfortunately, the marketing hype and the operational reality seem to be rather disconnected in certain cases.

The question you might ask is ‘What does estate agency look like in 10 years?’

The answer is that there will be no online vs high street in the same way that there are not ‘online travel agents’ vs ‘high street travel agents’.

The clever move is for the incumbents to embrace, not fight nor fear the online agents and to learn from them and to work with them or even absorb them. The future is the best of both and the traditional guys, especially the large corporates, will not and cannot survive without buying the scars of the knowledge, the learnings, the customer service culture, the technology, the marketing nuances and the nouse of the ‘new’ players. Having said that, almost all of the other online/hybrid agents in our space have not developed their technology enough (or at all) to be a worthy target for the ‘old’ industry to invest in and so in reality bona fide choice is very, very limited indeed.

The consumer will decide where this goes in the end and we at eMoov are confident that we have that figured out better than anyone.

Many thanks to Russell Quirk of eMoov for taking on these in your face questions!

Interview by Christopher Walkey, Founder of Estate Agent Networking.

You May Also Enjoy

UK property sector gender pay gap keeps getting wider

UK property sector gender pay gap keeps getting wider and It now has the fourth largest gap across all UK industries The latest research from Yopa reveals that real estate remains one of the UK’s worst-performing industries when it comes to the gender pay gap, ranking as the fourth largest across all sectors after widening…

Read More Britain’s most expensive streets revealed

The latest edition of Rightmove’s Most Expensive Streets report reveals that Winnington Road in Barnet, London, retains its position as Great Britain’s most expensive street, with an average asking price of £12,538,095 Chester Square in Westminster is second, with an average asking price of £11,546,428 and The Bishops Avenue in Barnet is third, with a price tag of £8,930,650 East Road…

Read More Average mortgage deposit exceeds the average salary

In 62% of Britain’s housing markets, the average deposit exceeds the average salary The latest research from eXp UK reveals that in 62% of Britain’s housing markets, homebuyers must save a deposit that exceeds a full year’s earnings, underlining just how substantial the cost of homeownership has become across large parts of the country. eXp…

Read More Latest Halifax house price data shows a 1.3% increase

Here are some thoughts from the Industry Mary-Lou Press, President of NAEA Propertymark (National Association of Estate Agents), comments: “The latest Halifax House Price Index confirms that average property values have remained above the £300,000 mark for the second consecutive month, reinforcing the resilience of the UK housing market. Sustained pricing at this level…

Read More Halifax House Price Index February 2026

House prices rose in February as market maintains early-year momentum • House prices increased by +0.3% in February, following a +0.8% rise in January • Average property price is now £301,151, edging up to another new high • Annual growth of +1.3% is strongest in four months, up from +1.1% in January • Northern Ireland…

Read More These are London’s most imbalanced housing markets

The latest research from Benham and Reeves reveals the least balanced housing markets in London where for-sale stock most heavily outweighs rental stock, thus putting renters in a difficult position when trying to find a home in the capital. Benham and Reeves has analysed current residential property listings in London* to discover which boroughs offer…

Read More