What Morning Drink fuels the UK Estate / Letting Agency Industry?

Some of us simply have to have a cup of our favourite morning drink in the morning to get ourselves going, I am certainly right on this aren’t I?

Be it that first cup of coffee or milky tea, maybe you are into fruity smoothies or simply picking yourself up a can of energy drink on your way to the office when you’ve got up late?

I’ve worked in an estate agency environment a few times, a few years ago now, and it was usually some basic old kettle in the tiny back room kitchen with the cheapest red label tea bags and some foul instant coffee with usually the milk just about on the safe side of still being drinkable. Today I see many estate agents having stepped up their whole office drinks situation with much better instant coffee machines for staff and even offering drinks to customers – Especially London many agents have fridges in the front office to offer chilled drinks such as water / fizzy drinks. I have yet to see Champagne though of course many agents will undoubtedly have a bottle or two ready somewhere to celebrate those higher commission sales!

I remember a story a couple of years back showing Go Move having opened a combines coffee shop / estate agency that I had myself thought of previously when I once led an online estate agency concept – Create a place that will attract customers to spend longer in office browsing property.

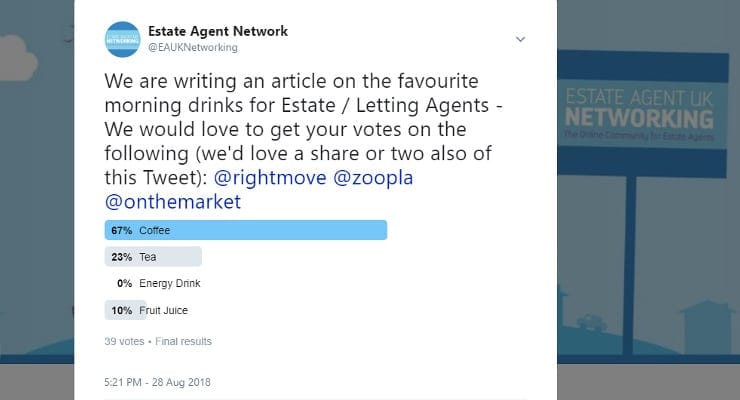

A quick survey on Twitter shows us that coffee leads the way for estate / letting agents with tea and fruit juice someway behind.