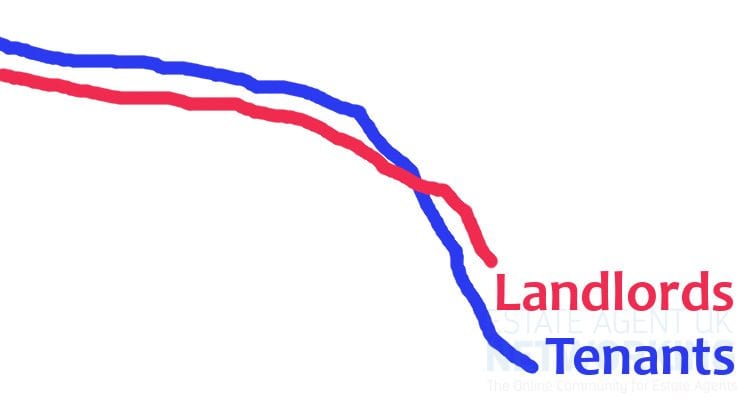

LANDLORDS FOLLOW TENANTS OUT OF CAPITAL AS RENTAL DEMAND NOSEDIVES

The central London rental market is beginning to show signs of topping out as tenant demand slides and landlords look to higher yielding investments in other areas of the UK.

New research* shows that the number landlords reporting a rise in tenant demand over the past quarter has slipped almost 30 percentage points when compared to the same point last year – down to 17 per cent from 45 per cent.

The findings also show that 40 per cent of landlords in the South East report a rise in tenant demand over the past quarter – the highest reported across the UK – indicating that tenants are increasingly looking to move out of central London to more affordable suburbs.

The perceived drop in rental demand in central London coincides with a more conservative approach from landlords to purchasing property in the capital in the coming months.

Just 5 per cent of landlords who operate in London say they plan to purchase more properties in the next quarter, the lowest across all regions and down from 15 per cent this time last year.

In contrast, the proportion of landlords operating in the North East who plan to buy in the next three months has almost doubled – up from 10 per cent this time last year to 19 per cent. The proportion of landlords in Yorkshire looking to buy has also jumped significantly from 10 per cent this time last year to 16 per cent this quarter.

All this comes as recent news from Countrywide shows that rents in the capital have fallen by 2.9 per cent over the past year.**

Carolyn Uphill, Chairman of the NLA, said:

“It looks like central London is simply becoming too expensive for most people, regardless of whether you want to buy, invest or rent.

“For many tenants the practical solution of moving out of the city to more affordable suburbs with good transport links is becoming increasingly appealing.

“In turn, it seems that landlords have been quick to respond, turning their backs on the capital and looking to other areas where the upfront cost of acquiring property is lower, and the potential yields to be had are higher”.

Breaking News from: Alex Brent alex.brent@landlords.org.uk