Finance

UK interest rate cut: what does it mean for borrowers?

The long-expected UK interest rate cut – the first since 2009 – became a reality last week. The base rate now stands at 0.25%, a record low. Although the Bank of England was wary of acting too hastily in the wake of the shock Brexit vote, it was clear a cut was on the cards…

Enness Private

5 reasons why you should use a mortgage broker

Securing a mortgage has previously been likened to a rite of passage, being something nearly all of us have to pass through when becoming responsible homeowners. Despite this, the long journey to meeting that milestone can seem a treacherous one, for some more so than others. As the mortgage market continues to prove an unpredictable…

Enness Private

Property investment is far more attractive with the low interest rates

With so much uncertainty doing the rounds of late relating to anything remotely connected with finance, whether that be savings, investments, business and even the economy. Ever since the UK voted to exit the EU we have seen the property sector placed firmly under the microscope and an array of predictions from experts across the…

Brexit fears result in Buy-to-let mortgage rates dropping

Lenders have slashed their buy-to-let mortgage rates and increased the amount they are willing to lend as a result of the Brexit result. Many of the biggest lenders have dropped their rates in an attempt to draw in new borrowers who may be looking to remortgage or purchase new properties. Following the rise in stamp…

Mark Burns

Guidelines for Investing In Student Property in the UK

Each year, numerous students shift to the UK for furthering their higher studies. In such cases, student property can be a lucrative option and a viable asset. Research shows that about £4 billion has been invested in this sector, in the first quarter of 2015. Also, according to the latest release of the GCSE research it…

Nationwide enters equity release mortgages market

As part of a revamp to its mortgage offering, Nationwide will be entering the equity release market, in line with its exploration into ways to help parents pass wealth onto their children and help homeowners unlock the wealth tied into their properties. The lender is currently planning to roll out its own ‘safer’ range of…

Enness Private

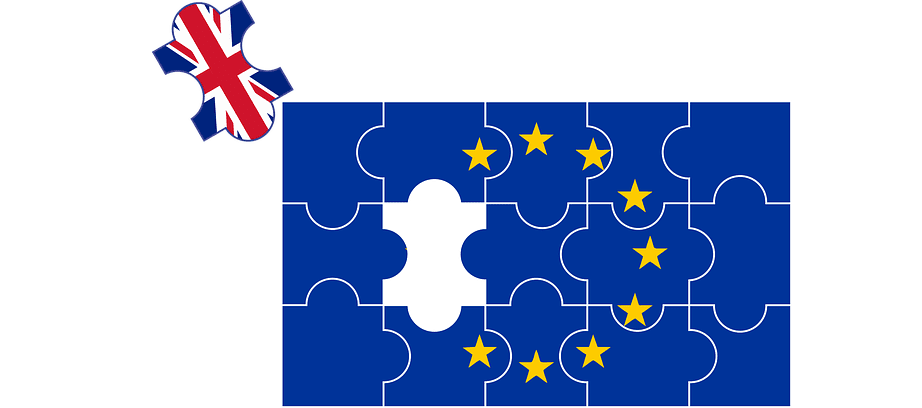

Market uncertainty makes it a nervous time for investors

The way in which the property market is moving is making it difficult for investors to make decisions. The referendum that is taking place on the 23rd June will determine whether Britain remain in the EU or leave it and until the result is announced the property market is going to move extremely slowly. Investors…

Mark Burns

More lenders commit to older borrowers & high LTV rates gap closes

Following the recent announcement that many high street lenders, such as Nationwide and Halifax, had decided to increase their maximum lending age limits, Family and National Counties Building Society re-affirmed their own commitment to this sector quite considerably. While many have only recently started to ease their lending restrictions for borrowers past state retirement age,…

Enness Private

Has the Bank of Mum & Dad Helped You Onto the Property Ladder?

The increasingly renowned Bank of Mum and Dad are expected to lend a helping hand to 25% of UK property transactions this year. In numerical terms this means that our parents are expected to fork out a combined total of over £5 billion, contributing to over 300,000 mortgages. Each set of parents are anticipated…

The future of buy to let mortgages

The future of buy to let has been a hot topic this week. In the wake of the Bank of England’s recent clampdown, prospective investors have been anxiously consulting brokers up and down the country. Lenders and borrowers alike have barely had time to draw breath since a host of tax changes were announced and, inevitably, the…

Enness Private

How Do Mortgage Lenders Respond to Japanese Knotweed on a Property?

When purchasing a house it is obvious that the potential buyer would get a surveyor to check the condition of the property and estimate its value. But what if the surveyor discovered the house (which the buyer thought would be his/her perfect home) contains Japanese Knotweed? How would mortgage lenders respond to a property with…

Have we Reached the Point of Too Much Tax on Property Investments?

When the most recent budget was announced it all became clear that there would be no relief from higher rates of Stamp Duty for institutional investors. Many are seeing this as the pivotal moment that investment property is being taxed too much. Taking you back to the 2015 Autumn statement that higher rates of Stamp…

Accord buy to let fixed rate remortgage deals discounted.

The buy to let arm of Accord Mortgages has now discounted a large selection of its 2 year fixed rate remortgage deals at up to 75% loan to value (LTV), including a mortgage fixed over a 24 month period now available at 2.34% for landlords with a 25% deposit. The latest fixed rate remortgage deals…

Enness Private

Wealthy frozen out by Mainstream Lenders.

It may seem contradictory that the very wealthiest borrowers are the ones who struggle most to secure the best mortgage deals from mainstream lenders. Believe it or not, this has been a prevailing market trend over the past few years. Amid concern lenders were issuing mortgages too freely, the Mortgage Market Review (MMR) – in…

Enness Private