Product Review: Black and Decker mouse sander

Do not be put off by its tiny size as this sander from Black and Decker really packs an almighty punch. It may appear that it is purely for those small home DIY projects such as sanding down old items of furniture, but we tested it on some old pine flooring within rooms of a house renovation and it does the trick.

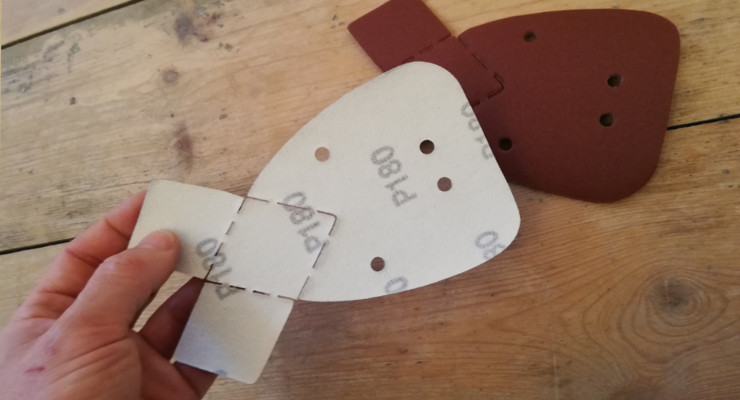

The Black and Decker mouse sander is available to purchase from many major DIY stores as well as online sales channels such as Amazon. The 55W and 11000rpm sander takes quick fit sander pads which can be peeled off and replaced easily as well as a removable tip / head allowing for varied profiles / shapes to be added for specific requirements.

It is a very compact design with a one hand and ease of usage – it is designed to fit in to awkward areas and tight corners.

Mouse sander on floor boards

Is it just for small jobs?

Certainly not. We tested the mouse sander on the flooring of two rooms of both 15m2 each and it easily (with plenty of sandpaper pad replacements) coped with removing the top layer of varnish / dirt from the boards.

Priced at around £20 per unit though we got ours from B&Q during a promotion at just £16 which included a pack of 5 x sanding pads / sheets.

Mouse Sander replacement sheets

Replacement sheets can be purchased at DIY outlets such as Screwfix.