WEEKLY NEWS ROUNDUP – 11/02/2022

A roundup of the week’s top property and proptech news stories in partnership with Proptech-X

- Coho secures £275k funding for its coliving and HMO solution

- Freddie Savundra: Is the future website forms or chatbots?

- Why is Purplebricks doomed?

- Rentd’s solution lays down yet another challenge for traditional agents

Coho secures £275k funding for its coliving and HMO solution

Before I say more, I must confess a connection with COHO, headed up by Founder Vann Vogstad, and Co-founders Liam Cooper and Helen Turner. They were among my original cohort of ten clients when Proptech-PR, my other day job, was founded. Proptech-PR is not a PR agency at all, but a property technology growth consultancy for founders like Vann.

At that time, Helen had not yet joined COHO and Gary Barker was not yet in the mix, but I was still struck that Vann Vogstad had a burning desire to make the lives of people in multiple occupancy properties much better at every level. The levers for change would be for the operators/owners of these properties to have a digital platform/software to manage all the moving parts. To say they’ve achieved that is an understatement…they’ve turned it on its head and brought something fresh to the table.

Vann’s vision was not just to have a SaaS model and monetise things like traditional solutions in the space, he wanted to enfranchise people renting rooms in properties, especially those getting a raw deal. He wanted these homes to be nurturing environments.

So it’s great to see that very early on COHO has secured financial backing from the MEIF Proof of Concept & Early-Stage Fund, which is managed by Mercia and part of the Midlands Engine Investment Fund and private investors.

COHO was inspired by Vann’s experience of house sharing in Birmingham after leaving university more than ten years ago. After building and selling two successful software companies, Vann – now a father of four – decided to address a gap in the market by creating the only platform of its type specifically designed for houses of multiple occupation (HMOs).

COHO aims to accelerate the growing trend of co-living amongst people of all ages. It allows property investors to manage their portfolio and tenants to find a suitable house to share with like-minded people. A double win.

Vann joined forces with long-term collaborator Liam Cooper to launch the platform in 2021. They have since signed up over 80 landlords and lettings agents managing thousands of rooms between them, further bolstered the executive team and strengthened the Board, with the appointment of former Reapit CEO Gary Barker as Non-Executive Director and experienced software executive Gordon Matthew as Chair.

The funding will allow the Worcester-based company to expand the team with the addition of five new jobs and develop a host of new features to improve the management of shared living.

Vann, who is the company’s CEO, said: “Co-living offers a positive lifestyle choice for many people living alone or struggling to afford their own home. By making house-sharing easier to manage for both landlords and tenants, COHO aims to bring it to the mainstream.

The support of our investors will enable us to move forward at a much faster pace to achieve our ambition of making shared living more accessible to both property investors and tenants, and becoming the Airbnb of house shares.”

Kiran Mehta, Investment Manager at Mercia, said: “The property management sector is ripe for innovation with many landlords, in particular those with HMOs, having to patch together multiple management tools. COHO offers a one-stop-shop for property management.

Vann and the team have carved out a strong niche in the HMO market and have plans for some exciting additions to the product roadmap. The investment will help bring forward these new features, build the team and enhance the sales and marketing activity.

It has been a pleasure working with Vann and the team over recent months and I look forward to supporting the business over the coming years.”

Ken Cooper, Managing Director at the British Business Bank, said: “One of the key objectives of the MEIF is to help businesses like COHO, develop new products and create new jobs. With Proof-of-Concept funding in place, COHO will be able to develop its property platform further. We encourage other businesses in Worcestershire and across the wider Midlands region to consider MEIF funding.”

Gary Woodman, Chief Executive of the Worcestershire Local Enterprise Partnership, said: “COHO is a business that I have had the pleasure of seeing develop first hand through their time on our technology accelerator programme, BetaDen.

I am delighted to hear that they have been able to continue their growth journey and secure additional funding with the ambition to create new jobs, helping to bring investment into the county and grow the local economy. I look forward to following their developments over the coming years.”

The Midlands Engine Investment Fund is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

If anyone out there does not know how great the tech is or the bigger vision that the team at COHO has, get on a conversation with them soon. This is a small company with a huge future, built around the UX needs of the person living in an HMO, and the person who owns or manages that vastly complex property asset.

Freddie Savundra: Is the future website forms or chatbots?

Freddie Savundra, the founder of Meet Parker, is an incredibly bright gentleman who is all about communication.

His company Meet Parker is an AI-driven mortgage, insurance and property assistant. Backed by industry leaders and partnered with best of breed tech firms such as iPipeline and Twenty7tec, it offer a different way to engage with clients and businesses, delivering enhanced lead conversion rates and a more streamlined sales and support process.

But I do not want to talk about his company too much, rather I want to in his own words educate anyone out there who is a property professional about the advantage of utilising a chatbot or bot, rather than hoping someone comes to your company website, will stay, and then fill in a form.

As Freddie asks, website forms or chatbots? It is a heavyweight contest. Here he is, in his own words:

Let’s get something clear from the beginning. Nobody likes chatbots. Given the opportunity, 99% of people would prefer to speak to a human – it’s perfectly normal. Humans give a sense of reassurance and more often than not can help with the answer there and then, if you can stand being on hold for an hour…

Here’s the secret Chatbot companies don’t want to tell you. Any half decent software engineer can build a chatbot in an hour – it’s not hard. Just think what you could do in a day…

“So why use them?

Put in the right place, a chatbot can become something quite clever, what we like to call Assistants here at Meet Parker. Here are 5 key things we’ve learnt when looking at refreshing your website, and why we think they beat website forms.”

Data is the new gold

To be GDPR compliant – Web Forms rely on the user clicking Submit. The more questions you ask on a form, the less likely the average Joe visiting your website is going to hit that shiny button where they send all their info your way. Chatbots are quite clever here, as the data they capture can be custom to the visitor that’s hit your site. So whether they’ve DM’d your Page on Instagram or click an Ad on Facebook, you can tailor the question set to make sure you are well positioned to help your clients.

Chatbots are 24/7

They don’t sleep, they don’t rest, they don’t get tired. As good as your enquiry line may be, with Sarah smashing the calls at 10pm, the cost ratio of having staff work through the night will never balance up. Chatbots help here, they can continually nurture your digital visitors, answer questions, until you’re ready to pick up the phone.

Chatbots are multilingual

Forms can change language based on your location (if you’ve set it up) – but how many forms can take information in one language and pass it to the support team in another. Very few.

Customer Experience

Clever chatbots have sentiment analysis and confidence scoring built in. That means if your Assistant doesn’t understand the question, he’ll pass to someone else who does. Picture the perfect client experience, except rather than waiting for Sarah to get here Manager, your Assistant has already lined them up. We call that streamlining the client experience.

Chatbots can adapt

Believe it or not, digital Body Language is a real thing. Forget cookies, forget your age and income. Think the way you communicate, the way you type, the length of time you spend on a page, how many forms can change their style based on the pages you’ve visited before? Very few. Assistants do this very well.

Where very few people venture…. is a combination of an Assistant and Website Form, what we like to call Parker in a Box. Imagine giving your clients the option of how much personal data they want to provide, catering right the way through to a full fact find.

That’s where the future is, that’s what Meet Parker Assistants do.

Why is Purplebricks doomed?

Over the last four years, I have written over ninety pieces on Purplebricks and over twenty articles and analytical reports based on the online agency model. Just to be clear, I do not dislike the concept of the general public having another option to sell and let property which is different from the traditional agency model.

What I have an issue with is that the digital transformation of real estate, the digitising and digital reimagining of how to do things more efficiently using the power of technology and software, falls very short in the present online models of selling property. Purplebricks, as the market leader in its sector, has not upped its game for years.

In fact, it is now moving towards being more of a traditional agency than at any time since its inception. It is ironic that years ago Alison Platt, the CEO of Countrywide Plc, pivoted and thought changing Countrywide’s model to a Purplebricks low fee model would buy the market. It failed.

Now Purplebricks are trying to be a corporate agency, except without the workforce and offices needed. With the introduction of refunds if they fail to sell, PAYE employees may be the final pivot, or perhaps it’s a no sale no fee model, or even buying some offices and cutting that huge media spend.

The one USP Purplebricks had was their anti-agent advertising because they charged a commission, knowing that for the 10% of vendors who are fee sensitive, this would be a draw and a common call to action.

The hidden dynamic being the LPEs is that they were all earning an instant commission from taking the instruction. A hidden mechanism, incentivise listers to get stock onto the market. The more you list, the more cash for the company and more monthly commissions for the LPEs.

Do I think online agents are doomed? No.

Do I think the current online agency model of Purplebricks is doomed? Yes.

Why? Because they have fallen into a trap. Someone looked at the analogue system of the agency, a paper-based and traditional system, and subtracted as many people as they can get away with. In their place, they’ve added just a dash of technology, thinking that it’s up to the task of replicating the human element and providing enough efficiency and value to keep them coming back.

The desired outcome was simple – an agency that sells a certain type of property at a certain price point in certain geographic areas, designed with a cost-conscious client in mind.

However, it’s been far from simple. Purplebricks has burnt through hundreds of millions to keep the dream alive. Just imagine if that had been spent on proptech experts, coding and proper digital transformation to create real proptech solutions for antiquated processes.

We’d be seeing something very different, that’s for sure.

“With many sectors and categories having seen a significant shift online during the pandemic the Estate Agency sector has not followed suit with a relatively low & slow rate of growth persisting.”

If I was in CEO Vic Darvey’s place I would have gone to the general public with a question. In the next five years, how will you be doing property? Buying it, selling it, renting it… letting it out? Also, what technology will you be using to transact in your daily life?

Instead, their bright idea was to sponsor the Olympics and burn cash on television advertising. Pure genius? Or is it pure genius for the coffers of the advertising partners? There is a big reason estate agents in the main do not burn millions in vanity advertising projects, they do not work.

Where it has all gone wrong is that agile new businesses are outfoxing huge corporate businesses, the type accustomed to peeking at their competitors and then tweaking their business models to make marginal gains. True digital businesses do not play by these rules.

Digital transformation has changed the accepted rules of business. But some businesses don’t accept digital transformation in the truest sense. By digital, of course, I mean the super-fast and frictionless way insurgent companies burst onto the scene.

They operate more efficiently, connecting people and products, services, devices and supply chains together. They’re the ones who achieve success through novel business strategies.

If you want to be an online success then it is time onliners became digital, for real. Purplebricks, let’s not forget, has over 60,000 vendors out there in the UK. It shows that a huge chunk of the public wants to do things differently. It shows that they’re frustrated, too. They see other areas of their life – entertainment, shopping, travel – made a great deal more efficient by technology, not just a little bit.

What is clear in our shared economy is that a fast and great user experience will drive transformation. People will adopt it. The signals are already there.

Take the relatively recent rise in micro home deliveries, for example. Paying £1.80 to have a packet of nappies delivered to your door in 10 minutes shows us when, how and where people want to use these types of services.

Now get some future-focused people and build a proper team to solve the problems that the public have when doing property. To all the bright young people out there, here is your challenge – build that online agency, make it like Amazon, and you will scale the world.

Sadly for Purplebricks, whose stock price is now sub 20p a share, it has forgotten its roots.

Purplebricks claims to be a digital business, but true digital businesses innovate at scale, use strategy to get to the top quickly and stay there, add value to customers, offer new value propositions, drive significant efficiencies and profit.

Just one year ago, Purplebricks made a profit of £6.8 million after six months for its total operations, now Vic Darvey announces a £20.2 million loss.

That’s a significant downturn. You do the maths and you’ll see what I’m getting at.

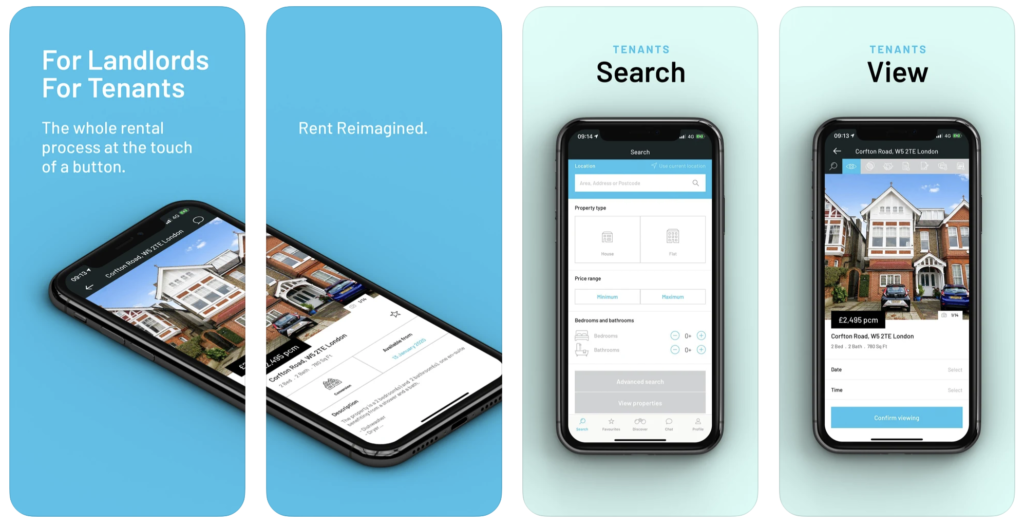

Rentd’s solution lays down yet another challenge for traditional agents

As well as being a journalist and editor, my day job is helping founders of property technology SMEs grow their proposition. It is an interesting role as I get into meetings with complete strangers each and every day, all of whom are looking to digitally rewire how things are done in real estate.

Some years ago at such a meeting, I met the ever-smiling Ahmed Gamal. Ahmed is the founder of Rentd. As we talked, I thought to myself that this is a man on a mission. Turns out I was right. He wanted to bring speed, transparency and drive efficiencies into the landlord and tenant process, as many landlords in the PRS let properties themselves.

The genesis of any new software solution to an analogue process, in a nutshell, starts with a founder. In this case, Ahmed decided one day that he saw a problem, which is addressed as such: “Rentd’s key mission is to break through barriers which exist in today’s rental market for both landlords and prospective tenants by streamlining the cumbersome rental process … Rentd replaces high agent fees with a fixed fee to landlords only, only payable once property is let, and no renewal fees.”

Ahmed felt that advanced software if coded correctly could power the finding and moving in part of the landlord-tenant journey. So, his digital solution to the problem he wants to address is to have landlords and tenants use Rentd.

“Rentd…a digital platform that takes renting into the virtual world, thus challenging a market currently dominated by high street estate agents and DIY online platforms. The platform empowers landlords and tenants to take back control of their rental journey, in what is currently a market dominated by high street estate agents and DIY online platforms.”

Like all true innovators, Ahmed put a new twist on a very old problem – communication in the lettings process.

“Rentd addresses the lack of transparency and trust in the industry by opening lines of communication for tenants and landlords to negotiate rent, terms and conditions, directly with one another.”

By building a digital channel for the two parties to talk at speed, the grindingly slow process of letting can move forward much smoother, and much quicker.

After an initial meeting with Ahmed, I have been following his journey with great interest. Over the years I’ve watched him work diligently, trying to get the sort of traction that is often hard in the B2C space.

With a market capitalisation of £5 million, Ahmed Gamal and Lawrence Hansford, and the rest of the team at Rentd, have raised £250k of investment to keep the business moving forward, continuing on their quest to offer a brilliant user experience for the tenant and the buyer. The investment comes from Wealth Management Partners.

So, because letting agencies service a swathe of landlords, they themselves use CRMs and other software to do this, like Reapit for example. Could the majority of DIY landlords out there who have only a single property to let utilise Rentd as their go-to solution?

Clearly from my own viewpoint, as an ex-agent and indeed as a former landlord who started dealing with my own tenants back in the late 1980s, the concept of not using a letting agent and having an app to do it for me would seem a sensible idea in the 2020s, as there is definitely a large addressable market.

Rentd is available on the app store. When you see the tagline, “Rent reimagined” you’ll know you’re in the right place.